TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

Industry Overview

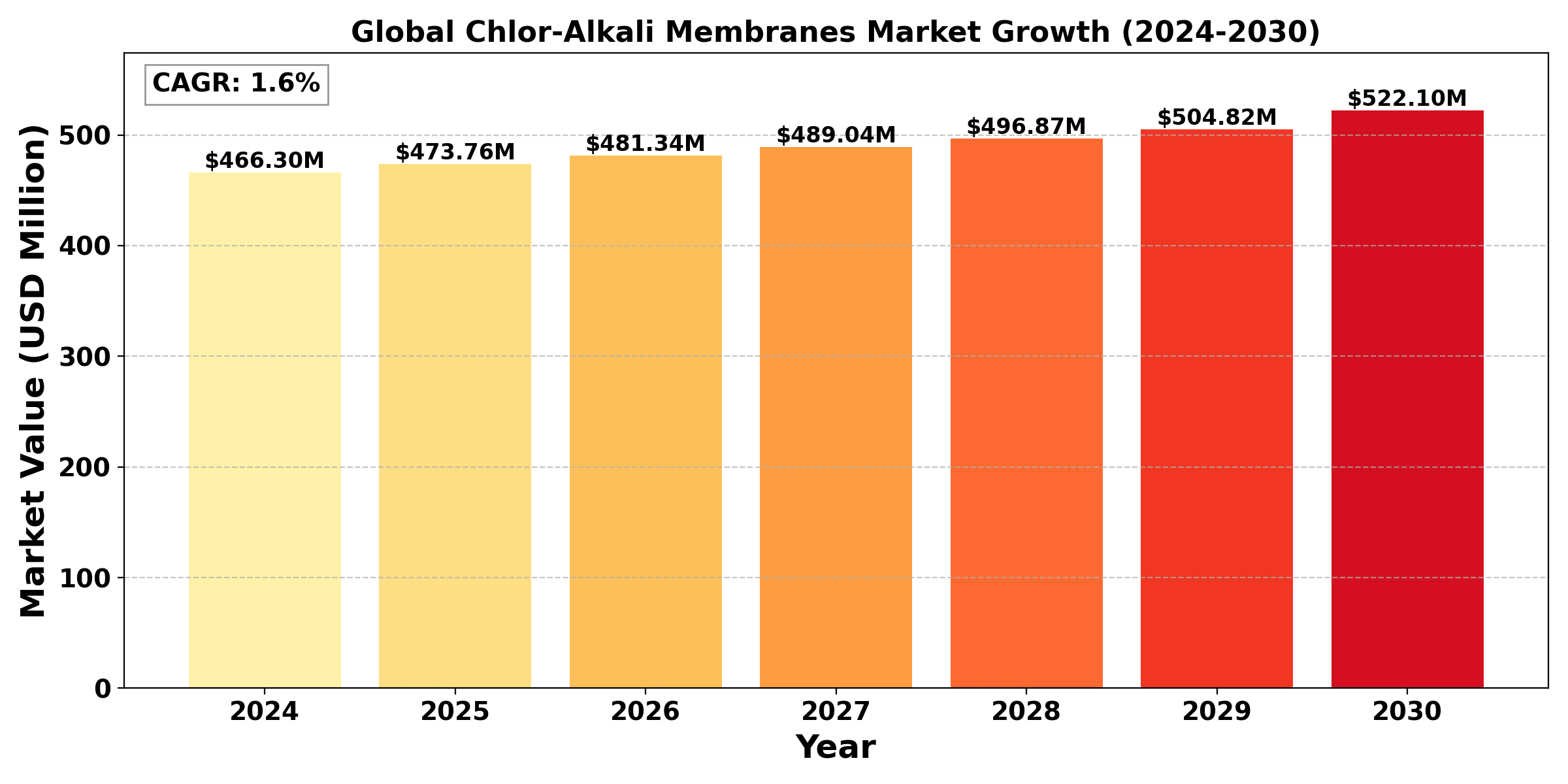

The "Global Chlor-Alkali Membranes Market" was valued at US$ 466.3 Million in 2024 and is projected to reach US$ 522.1 Million by 2030, at a CAGR of 1.6% during the forecast period

Chlor-alkali Ion Exchange Membrane is used in electrolyzers at electrolysis plants in which brine is decomposed. It plays a key part in manufacturing caustic soda (sodium hydroxide)/caustic potash (potassium hydroxide), chlorine, and hydrogen-basic chemical products required in our daily lives. The chlor-alkali processes rely on an ion-exchange membrane to separate the sodium and chloride ions of the sodium chloride.

The chlor-alkali membranes market is a vital segment of the chemical industry, primarily focused on the production of chlor-alkali products, including sodium hydroxide (caustic soda), chlorine, and hydrogen. This process involves the electrolysis of brine (saltwater) using membrane technology, which has gained popularity due to its efficiency and environmental benefits compared to traditional diaphragm and mercury cell methods. Membrane technology not only enhances product purity but also reduces energy consumption and minimizes waste generation, aligning with the growing demand for sustainable industrial practices. The market for chlor-alkali membranes is driven by several factors, including the increasing demand for caustic soda in various applications, such as chemical manufacturing, pulp and paper, and water treatment. Additionally, the rising need for chlorine in the production of disinfectants, plastics, and other chemicals further fuels market growth.

Segmental Overview

High Performance to hold the highest market share

Compared to high-strength and other varieties, high-performance membranes have the largest market share in the worldwide chlor-alkali membranes market. High-performance membranes are made especially to increase the chlor-alkali electrolysis process's durability and efficiency, which raises the purity of the final products, such chlorine and sodium hydroxide.

High-performance membranes are in high demand because of their capacity to drastically cut energy usage, boost output, and save operating expenses. These membranes are perfect for industrial applications where efficiency is crucial because of their cutting-edge materials and design elements that maximize ion transport and reduce resistance.

High-performance membranes are anticipated to become more popular as industries place a greater emphasis on sustainability and minimizing their negative effects on the environment, hence enhancing their market dominance. High-strength membranes, on the other hand, are crucial for some applications but fall short of high-performance choices in terms of application diversity and general demand. All things considered, the chlor-alkali process's predilection for high-performance membranes highlights how important these membranes are to increasing chemical industry productivity and efficiency.

Chlor-alkali production to hold the highest market share: By Application

Of the applications type, chlor-alkali production has the largest market share in the global market for chlor-alkali membranes. In this section, brine is electrolyzed to yield necessary compounds such as hydrogen, sodium hydroxide (caustic soda), and chlorine. Since these chemicals are essential to many industries, such as pulp and paper manufacturing, water treatment, and chemical manufacturing, the production of chlor-alkali is a crucial industrial activity. The extensive usage of chlor-alkali compounds in a variety of applications, including industrial chemicals, polymers, and disinfectants, is what propels their market domination. The need for chlor-alkali membranes is largely driven by the continuous expansion of companies that use these chemicals since they improve electrolysis process efficiency and product purity.

Chlor-alkali membranes are also used in chemical manufacturing and other applications, although their market share is less. The strong demand for caustic soda and chlorine, as well as the growing emphasis on sustainable and energy-efficient production techniques, solidify chlor-alkali production as the market leader for chlor-alkali membranes worldwide.

Regional Overview

The global market for chlor-alkali membranes exhibits significant regional patterns due to factors like environmental laws, industrial growth, and technological advancements in production. Because of the rising industrialization and urbanization of nations like China and India, the Asia-Pacific market is the largest and fastest-growing for chlor-alkali membranes. This expansion is supported by the need for caustic soda, chlorine, and related chemicals in industries like water treatment, chemicals, and textiles. Furthermore, membrane-based chlor-alkali processes are becoming more popular due to their sustainability and efficiency as regional governments place a greater emphasis on minimizing environmental effects.

With developed industrial bases and stringent regulatory frameworks that promote the use of membrane technology over conventional procedures, North America and Europe are particularly important markets. There is a consistent need for high-performance chlor-alkali membranes in these areas as a result of enterprises placing a higher priority on environmentally friendly and energy-efficient practices. Adoption of cutting-edge membrane technologies is encouraged by the European Union's strict environmental standards, which are specifically designed to reduce emissions and pollutants.

In the meantime, as industrial capacities increase, demand is rising in emerging countries in Latin America and the Middle East and Africa. These locations are positioned as potential future growth areas for the membrane market due to investments in water treatment facilities and infrastructure, which raise demand for chlor-alkali chemicals. The market is dynamic generally, and growth trajectories are being shaped by technical innovation and sustainability in every region.

Competitive Analysis

The global chlor-alkali membranes market is highly competitive, driven by key players investing in advanced technology and sustainable solutions to maintain market share. Leading companies, such as Asahi Kasei Corporation, AGC Inc., The Chemours Company, and 3M, dominate the market with a focus on high-performance membranes that enhance production efficiency and reduce environmental impact. These players leverage strong R&D capabilities and proprietary technologies, allowing them to offer membranes with improved durability, energy efficiency, and chemical resistance, which appeal to industries prioritizing operational sustainability.

End Use Industry Analysis

Several important end-use sectors, such as chemicals, water treatment, paper & pulp, and textiles, are the main drivers of the global market for chlor-alkali membranes. Chlor-alkali membranes play a critical role in the chemical industry's production of vital goods such as hydrogen, chlorine, and caustic soda, which are used as raw materials to make PVC, fertilizers, and solvents. The need for chlor-alkali membranes is anticipated to increase dramatically as the chemical industry expands, particularly in emerging nations. Chlor-alkali membranes are used in desalination and purifying procedures in the crucial field of water treatment. The demand for cutting-edge water treatment technologies is fueling this industry, especially in Asia-Pacific and the Middle East, due to rising water scarcity and pollution levels globally.

In the paper and pulp industry, caustic soda produced through the chlor-alkali process is essential for pulping and bleaching, making the sector a consistent consumer of these membranes. Additionally, textiles rely on chlor-alkali products for dyeing and processing fibers, with demand growing as textile production expands globally. As environmental regulations tighten, companies in these industries are adopting chlor-alkali membrane technology, known for its energy efficiency and reduced environmental impact, positioning it as a sustainable choice to meet rising industrial demand across various sectors.

Industry Dynamics

Industry Drivers

Rising Demand for Energy-Efficient and Environmentally Friendly Production Processes

The growing need for ecologically friendly and energy-efficient production methods is one of the main factors propelling the market for chlor-alkali membranes. Conventional processes for making chlor-alkali products, like caustic soda and chlorine, use a lot of energy and frequently produce a lot of trash. Industries are rapidly turning to membrane cell technology, which is much more effective and environmentally friendly, as environmental restrictions tighten globally. This technique complies with tighter emissions and waste disposal laws by minimizing byproducts in addition to consuming less energy.

Membranes are being used by businesses in industries including water treatment, paper, and textiles where chlor-alkali products are crucial to achieving sustainability and operational efficiency objectives. Given the rising cost of energy in many regions of the world, industry pressure to reduce operating expenses is another factor driving demand for chlor-alkali membranes. Additionally, manufacturers are being forced to switch to membrane technologies as a result of consumers and regulatory agencies favoring businesses with smaller environmental footprints due to growing knowledge of sustainable practices. Therefore, as businesses throughout the world place a higher priority on efficiency and adherence to environmental regulations, the market for chlor-alkali membranes is expected to grow.

Industry Restraint

High initial investment and maintenance costs associated with membrane cell technology.

The high upfront and ongoing expenses of membrane cell technology are a major barrier to the market for chlor-alkali membranes. To attain its high-efficiency performance, membrane cell technology necessitates specialized materials and infrastructure, in contrast to conventional diaphragm and mercury-based methods, which are less capital-intensive. Installing these cutting-edge systems frequently involves significant up-front expenses, such as the cost of locating premium membranes, adapting already-existing facilities, and educating staff on how to properly use and maintain the equipment.

These exorbitant expenses may be a major deterrent to adoption for smaller producers or those operating in developing nations. Furthermore, membrane cells can be susceptible to contaminants in the brine feedstock, requiring more maintenance and perhaps causing downtime if contamination happens, even if they are made to be efficient and environmentally compliant. Operating costs are further increased by routine membrane maintenance, monitoring, and replacement, which has an effect on profitability, particularly in areas where prices are sensitive.

Industry Trend

Rapid Advancement in membrane materials and technologies

Another significant trend in the global chlor-alkali membranes market is the rapid advancement in membrane materials and technologies. Innovations in materials science, such as the development of advanced ion-exchange membranes, are enhancing the performance and longevity of chlor-alkali membranes. These new materials offer improved conductivity, chemical resistance, and mechanical stability, resulting in higher efficiency and lower operational costs for producers. Additionally, ongoing research is focused on creating more durable membranes that can withstand harsh chemical environments while maintaining high permeability and selectivity. This progress is particularly important as industries demand membranes that can operate effectively at higher temperatures and in aggressive conditions, which is common in chlor-alkali production. The adoption of nanotechnology and composite materials is also on the rise, enabling the design of membranes with tailored properties to optimize specific applications. As a result, manufacturers are increasingly investing in R&D to innovate and commercialize next-generation membranes, thus positioning themselves competitively in the market. This trend not only enhances production efficiency but also aligns with sustainability goals, as improved membranes contribute to reduced

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|