TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

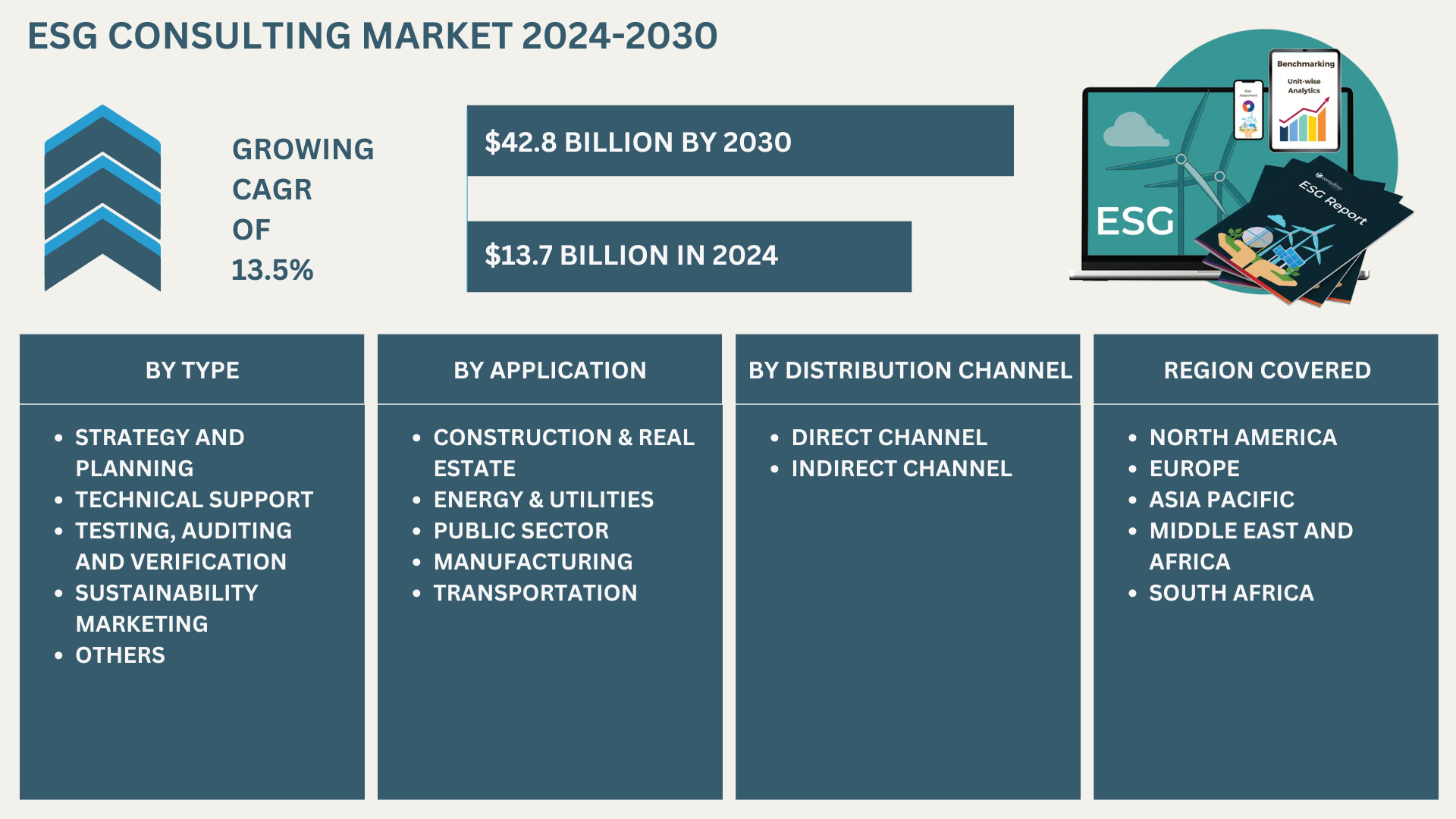

The Global "ESG Consulting Market" size is estimated to be $13.7 billion in 2024, it will reach $42.8 billion by 2030, growing at a CAGR of 13.5% during the forecast period from 2024 to 2032.

The market for environmental, social, and governance (ESG) consultancy is growing quickly as companies place a higher priority on sustainability and ethical conduct. Advisory services that assist businesses in incorporating ESG concepts into their plans, operations, and reporting procedures are included in this sector. Growing regulatory challenges, investor demands for transparency, and consumer preferences for socially conscious businesses are some of the main growth drivers. ESG consulting services include social impact assessments, governance structure optimisations, sustainability assessments, and carbon footprint analyses. The need for specialised consultancy experience is anticipated to increase as businesses look to strengthen their ESG credentials, propelling future market expansion.

In order to help businesses connect their operations, strategy, and reporting with ESG standards, this industry offers specialised consultancy services. The ESG consulting market is expanding due to several factors, such as legislative obligations, investor scrutiny, and increased consumer awareness of corporate sustainability. Businesses who want to show their dedication to moral behaviour and manage risks, improve their brand, and draw in investment are looking for ESG consulting services. Numerous services are provided by the industry, including as risk management, sustainability assessments, ESG strategy formulation, and reporting. The ESG consulting market is anticipated to grow as the emphasis on sustainability increases globally, with consulting firms being essential in assisting companies in navigating the intricacies of ESG integration.

Strategy and planning segment to hold highest market share: By Type

In terms of type the ESG Consulting Market has been segmented as Strategy and Planning, Technical Support, Testing, Auditing and Verification, Sustainable Marketing and Others.

The "Strategy and Planning" section has the largest market share in the ESG consulting industry. This dominance is a result of businesses' growing need to create complete ESG plans that satisfy stakeholder demands, investor expectations, and regulatory constraints. Businesses are investing extensively in strategic planning to incorporate ESG concepts into their core operations as a result of mounting pressure to show their commitment to sustainability and ethical governance. Organisations can evaluate their present ESG performance, establish challenging objectives, and create workable plans of action for reaching these goals with the use of strategy and planning services. A crucial component of ESG consulting is this area, which also covers advice on risk management, regulatory compliance, and long-term value development. Over 75% of Fortune 500 companies report having engaged in ESG consulting services to improve their sustainability and governance practices.

The strategy and planning division offers a broad range of services, such as the construction of sustainability roadmaps that direct long-term decision-making and the establishment of ESG frameworks and ESG goals integrated into company strategies. This category of consulting services works closely with businesses to set quantifiable ESG goals, create activities to reach those goals, and coordinate ESG projects with more general business goals. This frequently calls for intricate analysis and cooperation across functional boundaries, necessitating specialised knowledge that consulting firms are well-positioned to offer.

Energy and Utility segment to hold highest market share: By Application

Among the different application sectors in the ESG consulting market, the "Energy & Utilities" sector has the largest market share. The industry's strong environmental effect, strict regulation, and the need to switch to more renewable and sustainable energy sources are the main factors contributing to its domination. Given that they are some of the biggest emitters of greenhouse gases, governments, investors, and consumers are putting more pressure on energy and utility firms to adopt more rigorous ESG policies. These businesses are heavily investing in ESG consulting services as a result of mounting pressure to lower their carbon footprints, increase energy efficiency, and implement cleaner technology. These services support clients in navigating intricate regulatory frameworks, creating emission-reduction plans, and integrating sustainable practices into all aspects of their business operations. Furthermore, in order to guarantee both environmental sustainability and financial viability, the transition to renewable energy sources and the incorporation of cutting-edge technologies like smart grids and energy storage necessitate thorough ESG policies.

In terms of Region, the market has been segmented as North America, Europe, Asia Pacific, Middle East and Africa and South America.

With almost 35% of the global market value, North America accounts for the greatest portion of the ESG consulting market. This is mostly because of the region's sophisticated regulatory environment, high investor awareness, and strong corporate commitment to sustainability. Companies operating in North America are obligated to adhere to a well-established system of Environmental, Social, and Governance (ESG) legislation and norms, mostly in the United States and Canada. These rules have increased the demand for specialised consulting services to assist firms in navigating the intricacies of ESG compliance and reporting. Additionally, investors have increased their pressure on companies to prioritise ESG criteria in their investment decisions.

The financial markets in the region are also very sensitive to environmental, social, and governance (ESG) aspects, since many institutional investors incorporate them into their investment plans. As businesses work to improve their sustainability practices and governance frameworks in order to meet these investors' expectations, this has generated a thriving market for ESG consultancy. The need for consulting services that can help with creating and putting into practice comprehensive ESG strategies is further fuelled by the fact that North America is home to numerous global firms that are setting the standard for ESG adoption. Furthermore, consumer awareness and demand for sustainable products and services are particularly strong in North America, prompting companies to seek ESG consulting to align their business practices with these preferences. The region's strong focus on innovation and technology also supports the growth of the ESG consulting market, as companies leverage advanced tools and analytics to enhance their ESG performance.

The ESG consulting market is characterised by a competitive landscape that includes both well-known consulting firms and niche companies striving for market share in a quickly expanding sector. The market is dominated by major firms like Deloitte, PwC, and EY because of their wide range of service offerings, strong understanding of regulatory compliance, and huge global networks. The ability to offer complete, end-to-end ESG solutions that incorporate strategy, risk management, reporting, and assurance services gives these businesses a competitive edge. However, by providing specialised services and cutting-edge methods catered to particular sectors or ESG factors, such carbon footprint reduction or sustainable supply chain management, niche consulting firms are becoming fierce competitors. These tiny businesses frequently set themselves apart with their adaptability, attentive customer care, and state-of-the-art knowledge in quickly developing fields like social impact assessments and climate risk modelling.

Strategic alliances and acquisitions are additional factors that define the market as companies look to improve their capacities and grow their customer base. Competition is growing as demand for ESG consulting services rises, spurring innovation and forcing businesses to continuously modify their services to satisfy the intricate and changing needs of customers in a range of industries.

Mandatory ESG Reporting and Disclosure Requirements

The increasing focus on required ESG reporting and disclosure is a significant development in the ESG consultancy sector. Globally, governments, regulatory agencies, and stock exchanges are pressing businesses to provide comprehensive disclosures regarding their governance, social, and environmental policies. A greater emphasis on corporate responsibility and transparency is driving this trend, with stakeholders—such as investors, consumers, and regulators—demanding more stringent and standardised ESG reporting. Consequently, in order to guarantee compliance, manage the intricacies of these new rules, and improve the legitimacy and openness of their ESG disclosures, businesses are resorting to ESG consultants. Because of the increasingly extensive and strict legal frameworks around ESG, this tendency is especially prominent in North America and Europe. In an effort to increase the precision and effectiveness of their reporting procedures, businesses are using technology and data analytics more frequently in ESG consulting as a result of the drive towards required reporting.

This trend is reshaping the ESG consulting industry, driving demand for specialized expertise and innovative solutions that can help companies meet the evolving expectations of regulators and stakeholders. As mandatory ESG reporting continues to gain momentum globally, it is expected to be a key driver of growth and transformation in the ESG consulting industry.

Regulatory changes

Regulations that are changing the way businesses handle sustainability and ethical governance are a major driving force behind the growth of the ESG (Environmental, Social, and Governance) consulting sector. Companies are under increasing pressure to adhere to these changing standards as governments and international organisations impose stricter rules and reporting requirements pertaining to ESG problems. A variety of recently enacted and amended regulations require comprehensive disclosures regarding environmental effect, social responsibility, and governance standards. Regulations may, for instance, mandate that businesses disclose information about their energy and carbon footprints, labour practices, diversity and inclusion initiatives, and governance structures in a more uniform and transparent way.

In addition to making ESG compliance more difficult, these legislative developments are also broadening the range of issues that businesses need to deal with. Because of this, businesses are looking to ESG consultants for their specialised knowledge to help them manage these regulations, guarantee correct reporting, and reduce the risks of non-compliance. ESG consultants offer vital support by assisting businesses with comprehending and putting into practice the most recent rules, creating plans to comply with disclosure obligations, and getting ready for audits and assessments. ESG consulting services are in high demand due to the increasing focus on regulatory compliance, which is a major driver of the industry's growth and development.

Lack of standardization in ESG reporting

The absence of standards for ESG reporting and measurement is a major barrier for the ESG consultancy sector. As of right now, there isn't a single, globally recognised methodology for gauging and disclosing ESG performance, leading to disparities between sectors and geographical areas. It is challenging to assess and measure performance since different companies report their environmental, social, and governance activities using different approaches and indicators. ESG consultants face a difficulty as a result of this lack of consistency since they have to customise their recommendations and solutions to meet a variety of reporting standards, which makes the consulting process more difficult.

When creating their ESG strategy, organisations may find it difficult to prioritise specific criteria or figure out how to maintain compliance with various reporting formats due to the lack of standardisation. This discrepancy may hinder the wider adoption of ESG practices and restrict the efficacy of ESG advice. Overcoming this constraint will be essential for the ESG consulting sector to continue expanding as stakeholders want more transparent and standardised reporting.

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides break down details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by types, applications, sales channel. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments: |

By Type:

By Application:

By Distribution Channel:

|

|

Region Covered: |

|

|

Key Market Players: |

|

|

Report Coverage: |

|