TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

Industry Overview

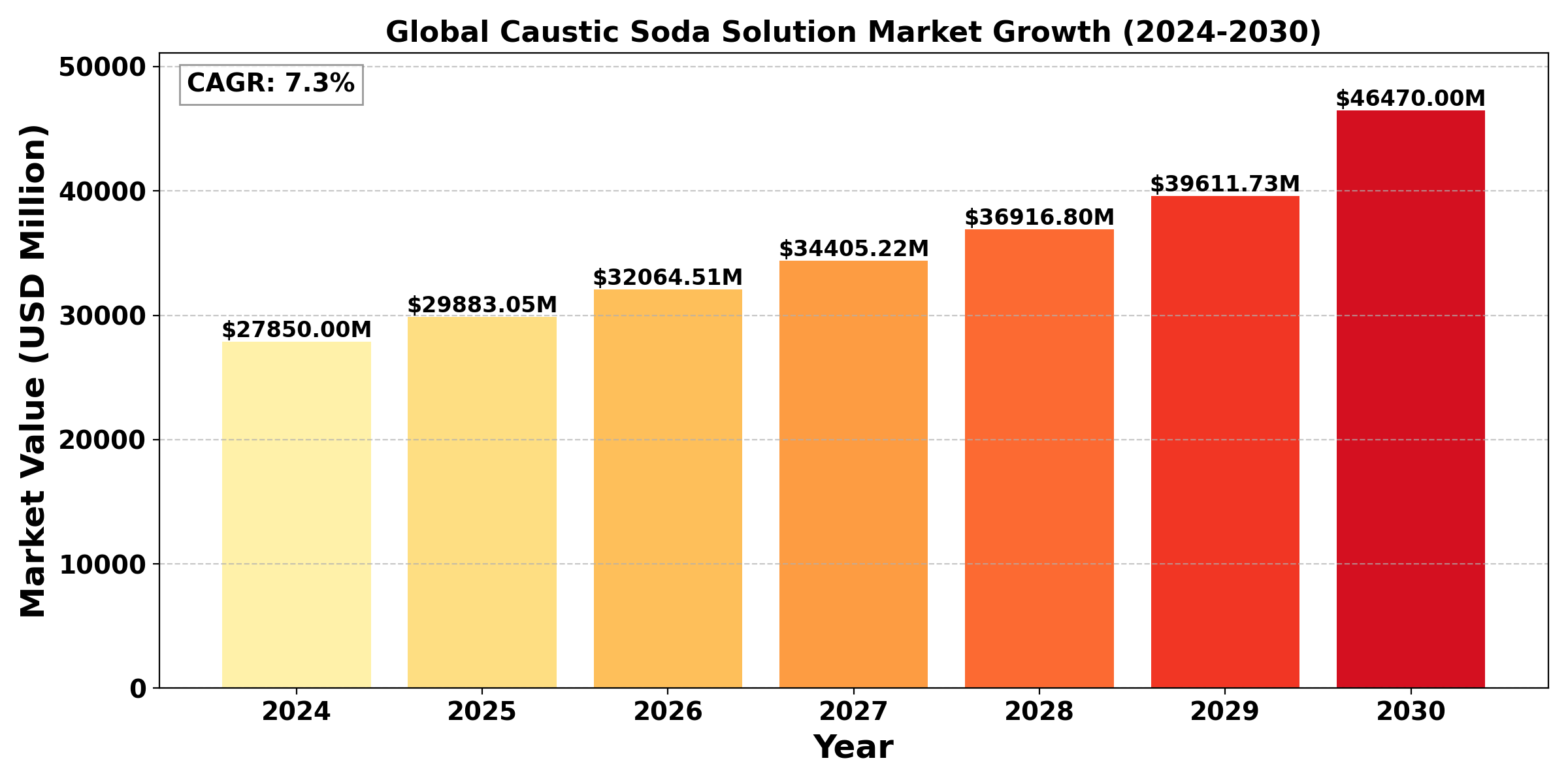

The "Global Caustic Soda Solution Market" was valued at US$ 27.85 Billion in 2024 and is projected to reach US$ 46.47 Billion by 2030, at a CAGR of 7.3% during the forecast period.

The Caustic Soda industry holds a significant part in the global chemical industry, this chemical plays an import role in application in diverse application across various end use industries. Chemically know as Sodium Hydroxide (NaOH), caustic soda holds exceptionally versatile application in various profound industrial significance, underpinning its widespread adoption and integral role in various sectors.

The Caustic Soda is produced through the electrolyzing brian in which a solution of sodium chloride is mixed in water, which leads to the yield of hydrogen gas, chlorine gas and the coveted caustic soda itself. The industry usually utilizes two main process in the production process I,e the mercury cell process and the membrane cell process. The mercury cell production has been significantly diminishing use has been less in use because of the environment hazardous that comes with it. However, the membrane cell process, is widely embraced for its superior environmental credentials utilizing ion-exchange membranes to separate chlorine and caustic soda efficiently.

The Caustic Soda holds a diverse application in various industry. In the Paper and pulp industry and acts as a linchpin for the pulping and bleaching processes, which leads to the transformation of raw material in a high quality paper product. Also, in the textile industry, the caustic soda holds a significant use in the fabric processing and bleaching leading to vibrant hues and enhancing the durability of textiles worldwide. Furthermore, the Caustic soda also serves as a fundamental ingredient in the production of array of chemical in such as soaps, detergents, to solvents and pharmaceutical ingredient, highlighting its significant role in the daily used products and different industrial process.

The Industrial dynamic for the caustic soda is influenced by various factors which includes the demand and supply dynamics in the end use industry ,the end use industrial growth, the fluctuation in price of raw materials, the availability of raw materials, supply chain dynamics etc. Furthermore, the industry is also poised by certain challenges such as the environmental concern from the production of chlorine gas emission during the production and energy-intensive processes underscore the industry's ongoing quest for sustainability and efficiency.

Segmental Analysis

30-54% to hold the highest market share: By Type

The 30–54% concentration group has the largest market share in the global caustic soda solution market. Because it strikes a balance between effectiveness and adaptability, this concentration range is the most widely utilized and can be used to a variety of industries. This concentration is preferred by industries like chemical manufacture, pulp & paper, textiles, water treatment, and aluminum processing because it offers potent caustic qualities while remaining safe and economical. This concentration is also preferred due to its effectiveness in neutralizing acids, regulating pH levels, and decomposing organic compounds, which makes it essential in a variety of industrial applications. The 30–54% caustic soda solution is widely used in various industries, which has led to its market domination.

The other segments, such as 10-30% and Others, which include concentrations above 54%, typically serve more niche or specialized applications. For instance, lower concentrations (10-30%) are often utilized in less aggressive cleaning applications or as a pH adjuster, while higher concentrations are reserved for industries that require greater causticity, such as certain metallurgical and chemical synthesis processes.

Pulp and Paper to hold the highest market share: By Application

The pulp and paper sector has the largest market share by application in the global market for caustic soda solutions. This dominance results from caustic soda's crucial involvement in the bleaching and pulping processes, which are necessary to the manufacturing of paper. In order to separate the cellulose fibers from the lignin in wood and turn raw wood into pulp, caustic soda is essential. It is an essential chemical in the creation of premium paper goods because of its alkaline qualities, which also aid in dissolving contaminants and enhancing pulp color.

In the pulp and paper sector, caustic soda is still in high demand because of the global expansion of packaging and tissue paper demand, which is being fueled by e-commerce, growing paper consumption, and hygiene awareness. Although caustic soda is used for a variety of reasons by other industries such as textiles, soap and detergent manufacturing, and chemical processing, their consumption is not as high as that of the pulp and paper sector. Pulp & paper is the industry category that consumes the most caustic soda solution due to its extensive use within the sector and its growth trajectory.

Regional Overview

The demand factors and trends in the global market for caustic soda solution vary by region. Applications in the pulp and paper, chemical processing, and water treatment sectors are the main drivers of the stable demand in North America and Europe, which are established markets. Strict environmental laws in these areas have an impact on manufacturing techniques and encourage the development of innovative sustainable production methods. In contrast, Asia-Pacific is the market with the quickest rate of growth because to the fast industrialization and rising demand from sectors like paper, aluminum processing, and textiles in nations like China and India. The region is now a global leader in demand for caustic soda because to its thriving manufacturing sector and infrastructure expenditures.

Growth in Latin America is steady but moderate, especially in nations like Brazil and Mexico where the growing chemical, pulp and paper, and petroleum industries heavily rely on caustic soda. As industrialization picks up speed, demand in growing countries like the Middle East and Africa is rising, especially in the areas of water treatment and aluminum manufacturing. Due to its industrial base, Asia-Pacific dominates the market overall. North America and Europe follow, where market dynamics are influenced by an emphasis on innovation and environmental compliance.

Competitive Analysis

The global caustic soda solution market is highly competitive, with both established players and emerging companies vying for market share. Major players, including Olin Corporation, Westlake Chemical Corporation, Tata Chemicals, Dow Chemical Company, and Occidental Petroleum Corporation, dominate the market, leveraging their extensive distribution networks, strong brand reputation, and large production capacities. These companies benefit from economies of scale, allowing them to maintain competitive pricing and secure long-term contracts with key customers in industries like pulp and paper, chemical processing, and water treatment.

Recent Development

➣ In, 2022, The chemical division of Occidental Petroleum Corporation made the decision to investigate renovating a few chlor-alkali plants in order to boost output of caustic soda with a higher value and satisfy the company's expanding need for its main goods.

➣ In 2023, Covestro and Lanxess partnered to create raw materials that are more environmentally friendly and have a lower carbon footprint.

End Use Industry Analysis

The global caustic soda solution market is driven by diverse end-use industries, each with specific demands that shape overall market dynamics. A significant consumer is pulp & paper, which uses caustic soda extensively for fiber processing, bleaching, and pulping. The rise of this industry, which is driven by an increase in the need for hygiene goods and packaging, supports the steady demand for caustic soda. Another important sector is the chemical processing business, where caustic soda is essential for the production of different chemicals, such as solvents, polymers, and synthetic fibers. Because of the wide range of applications across industries, this sector offers stability to the market.

The market for caustic soda in textiles is expanding, especially in the areas of fabric processing, dyeing, and finishing. Global textile output, particularly in Asia-Pacific, is driving significant demand growth in this market. Caustic soda is used in the saponification process, which turns fats and oils into soap, in the production of soap and detergents. The growing emphasis on cleanliness and hygiene around the world is advantageous to this market. Aluminum processing also drives demand, as caustic soda is essential in refining bauxite into alumina, an intermediate in aluminum production. The expansion of the automobile and construction industries, especially in emerging nations, is linked to this demand.

The demand for caustic soda is also influenced by other sectors, such as water treatment and petroleum refining. It helps control pH levels and treat waste in water treatment, and it is used to eliminate sulfur and other impurities from petroleum. Overall, the market for caustic soda is resilient due to the variety of end-use sectors, as demand in one sector can counteract changes in another, supporting steady global expansion.

Industry Dynamics

Industry Drivers

Increasing demand from the pulp and paper industry

The growing demand from the pulp and paper sector is one of the main factors propelling the market for caustic soda solution. The increasing need for hygienic products and ecological packaging options, especially in light of the growing e-commerce trend, is driving this industry's comeback. The pulp and paper industry is adjusting by employing caustic soda to increase the production of recyclable materials as consumer preferences shift toward eco-friendly products. In order to create high-quality pulp for a variety of paper goods, such as tissue, packaging, and printing paper, caustic soda is essential to the pulping process. It does this by dissolving lignin and separating cellulose fibers. The continuous growth of the pulp and paper industry also increases the demand for caustic soda, making it an essential component in the production of essential paper goods and supporting the market's overall expansion. Technological and production process advancements are also allowing paper manufacturers to optimize their use of caustic soda, improving efficiency and lowering costs. Additionally, global efforts to reduce plastic usage further amplify the need for paper-based alternatives, driving increased investments in the pulp and paper sector.

Industry Trend

Shift towards sustainable and eco-friendly production practices

The move toward environmentally friendly and sustainable production methods is one notable development in the market for caustic soda solutions. Manufacturers are concentrating on lowering the carbon footprint related to the manufacturing of caustic soda as environmental concerns and regulatory demands grow on a global scale. Growing awareness of the negative environmental effects of conventional industrial techniques, which frequently rely significantly on energy-intensive procedures and increase greenhouse gas emissions, is what is driving this movement.

To address these concerns, companies are investing in more energy-efficient technologies and exploring alternative production methods, such as the electrolysis of brine, which offers lower emissions compared to conventional methods. Additionally, there is a rising interest in developing bio-based or less harmful alternatives to caustic soda for specific applications, particularly in industries like textiles and food processing, where sustainability is becoming a key purchasing criterion. Businesses are investigating alternate manufacturing techniques, such electrolyzing brine, which offers lower emissions than traditional methods, and investing in more energy-efficient equipment to allay these worries. Furthermore, there is growing interest in creating bio-based or less hazardous substitutes for caustic soda for certain uses, especially in sectors like food processing and textiles.

Industry Restraint

Price Volatile of Raw Material

Price volatility for raw materials, especially sodium hydroxide and chlorine, which are necessary for the production of caustic soda solution, is one of the main factors limiting the market for this product. These raw materials' cost and availability are directly related to the production of caustic soda, and changes in their price can have a big effect on the total cost of production. The pricing structure of caustic soda can be impacted by factors such supply chain disruptions, trade policy changes, and geopolitical tensions that raise the cost of raw materials.

Concerns regarding sustainability and regulatory compliance are also raised by the industrial process's dependency on fossil fuels and non-renewable resources. Manufacturers may have to make more operational adjustments and pay higher compliance costs as governments throughout the world impose stronger environmental rules, which might put more pressure on profit margins.

Furthermore, a competitive challenge that can restrict market expansion is the appearance of substitute materials and chemicals that can be used in place of caustic soda in particular applications. Businesses must balance the need for sustainable and affordable solutions with these difficulties, therefore they must create plans that reduce the risks brought on by fluctuating raw material prices and regulatory demands.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|