TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

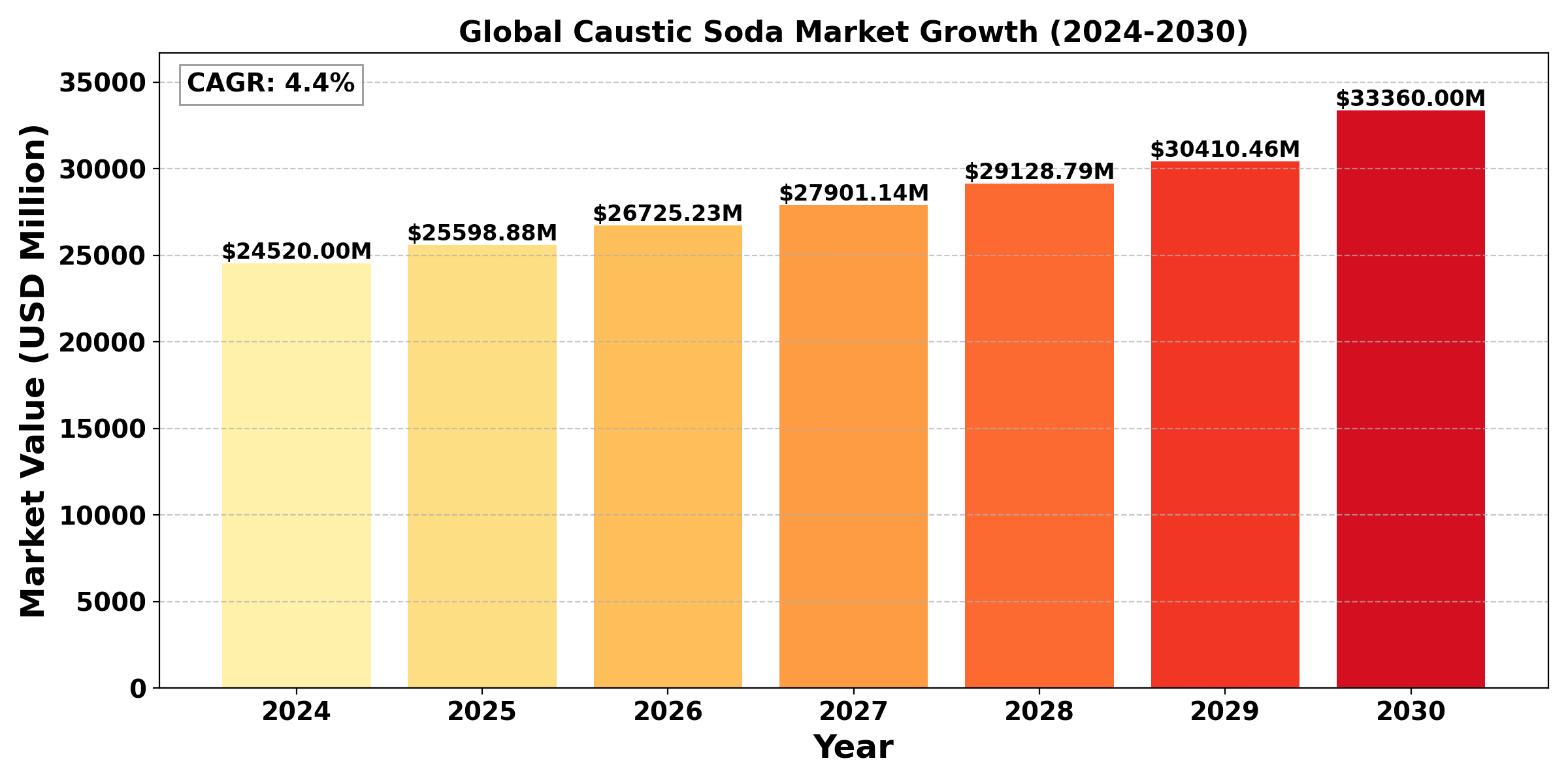

Market Poised for Growth: The global Caustic Soda market was valued at US$ 24520 million in 2024 and is projected to reach US$ 33360 million by 2030, at a CAGR of 4.4% during the forecast period. The caustic soda industry is likely to be dominated by the Asia Pacific region, this region is likely to hold the highest growth rate during the forecasted period driven by factors such as rapid industrialization, growing demand from the pulp and paper industry, chemical industry, the rising urbanization and the ever evolving manufacturing activities in countries like India, China, Japan etc., is likely to contribute to the industrial growth in the region. Furthermore, the North America region is also expected to hold a significant growth rate during the forecasted period followed by Europe, Middle East and Africa and South America.

The caustic soda industry, primarily characterized by the production of sodium hydroxide, plays a pivotal role in various industrial applications, making it one of the most essential chemical compounds globally.It is mostly made by electrolyzing brine, which highlights the interdependence of the chemical industry by producing chlorine gas as a byproduct. Various end-use sectors, such as pulp and paper, textiles, soap and detergents, chemical processing, and aluminum production, are served by the caustic soda market. This market is expanding significantly because to the rising need for recyclable and sustainable materials, especially in the pulp and paper industry. Additionally, firms are now more competitive as a result of adopting more efficient production techniques in response to the push for ecologically friendly operations. However, the industry faces obstacles like stringent environmental laws and fluctuating raw material prices, which can affect market stability and production costs. Due to growing manufacturing capacity and fast industrialization, the Asia-Pacific region is the largest consumer geographically. The caustic soda sector is poised for expansion as the world economy changes, with advancements in sustainability and production influencing its future while meeting the growing need for environmentally friendly products.

Segmental Overview

Liquid Caustic Soda to hold the highest market share: By Type

Among the several varieties, liquid caustic soda has the largest market share in the worldwide caustic soda market. Its broad application and versatility across numerous industries are the reasons for its supremacy. Because it is easy to handle and store, liquid caustic soda is mostly used in the production of chemicals, pulp and paper, and water treatment procedures. The liquid form is especially advantageous for large-scale industrial use since it enables effective mixing and application in a variety of processes.

The demand for liquid caustic soda is also fueled by the rising demand from sectors like textiles, soaps, and detergents that need large amounts of caustic soda. Its popularity is increased by its ease of transportation and application in liquid form, particularly in fields where accurate and timely application is essential.

Although solid forms, including flakes and particles of caustic soda, are also important, they are typically utilized in more specialized applications where particular handling or storage conditions are needed. Its position as a vital component of the worldwide supply chain is cemented by the general trend towards industrial efficiency and the growing need for liquid caustic soda in a variety of processes, which guarantees its sustained market dominance.

Pulp and Paper to hold the highest market share: By Application

The pulp and paper sector has the largest market share by application in the global market for caustic soda solutions. This dominance results from caustic soda's crucial involvement in the bleaching and pulping processes, which are necessary to the manufacturing of paper. In order to separate the cellulose fibers from the lignin in wood and turn raw wood into pulp, caustic soda is essential. It is an essential chemical in the creation of premium paper goods because of its alkaline qualities, which also aid in dissolving contaminants and enhancing pulp color.

In the pulp and paper sector, caustic soda is still in high demand because of the global expansion of packaging and tissue paper demand, which is being fueled by e-commerce, growing paper consumption, and hygiene awareness. Although caustic soda is used for a variety of reasons by other industries such as textiles, soap and detergent manufacturing, and chemical processing, their consumption is not as high as that of the pulp and paper sector. Pulp & paper is the industry category that consumes the most caustic soda solution due to its extensive use within the sector and its growth trajectory.

Regional Overview

The global caustic soda market exhibits distinct regional characteristics, driven by varying industrial demands and economic activities. Rapid urbanization and industrialization in nations like China and India are the main drivers of the largest and fastest-growing market in Asia-Pacific. The need for caustic soda is driven by the region's robust manufacturing base, particularly in the textile, aluminum, and pulp and paper sectors. Government programs encouraging sustainable practices and infrastructure development also aid in the expansion of the market.

Europe and North America are developed markets with consistent demand, especially for pulp and paper, water treatment, and chemical processing. Strict environmental laws and an emphasis on environmentally friendly production methods are reshaping the caustic soda market in these areas, pushing producers to develop and use greener technology.

Meanwhile, industrial development is increasing in rising areas such as the Middle East and Africa. The demand for caustic soda is anticipated to increase as these nations improve their industrial capacities, especially in the water treatment and aluminum production industries. All things considered, the caustic soda market's regional characteristics show a combination of long-standing industrial activity and new growth possibilities, setting the industry up for future growth.

Competitive Analysis

The Caustic Soda has the presence of large number of national as well as international players. Most of the company operating in this industry has been working continuously and investing heavily in the research and developmental activities, in order to manufacture environmental friendly products for instance. Companies has also been working towards collaboration and mergers and acquisition in order to expand its reach and enhance its product line some of the key players operating in the industry includes DowDuPont, OxyChem, Westlake Chemical, Olin Corporation, Formosa Plastics Corporation, Tosoh, Inovyn, Asahi Glass, Covestro, Shin-Etsu Chemical, AkzoNobel, Hanwha Chemical, Solvay, LG Chemical, Tokuyama Corp, SABIC, Kemira, Basf, Aditya Birla Chemicals, GACL, Joint Stock Company Kaustik, Sanmar Group, Unipar Carbocloro, Braskem, Kem One, Vinnolit, Evonik, VESTOLIT, Tessenderlo Group, Ercros etc.

Recent Development

➣ In April 2023, BASF and Thyssenkrupp Uhde Engineering announced their partnership to create a novel membrane technology for the production of chlor-alkali. This partnership demonstrates the industry's emphasis on caustic soda production methods that are more efficient and clean.

➣ February 2023, Gujarat Alkalies and Chemicals Limited announced the expansion of its Caustic Soda Lye Plant from 785 MTPD to 1310 MTPD of its Dahej Complex. As a part of the Caustic Soda expansion, a new 700 MTPD Caustic Evaporation Unit (CEU) was also commissioned to cater to the requirement of Caustic Soda Lye production (48% w/w)

Industry Dynamics

Industry Driver

Diversity in Application

The demand for caustic soda has been soaring globally due to its multifaceted application in various industries, in the paper and pulp industry caustic soda helps in the separation of woods fibres during pulping and enhances brightness in paper bleaching processes. The textile industry has been using caustic soda to enhance the cotton fibre strength and the absorption of dyes. The significant demand for the product has also been significantly rising because of the rapid industrial and economic expansion of countries like China, India, and the U.S etc. These booming economic countries has been driving the demand by utilizing and producing more of hygiene and everyday use products.

The Caustic Soda market is forecasted to grow at a compound annual growth rate (CAGR) of 4.4% between 2023 to 2030. China is the largest Caustic Soda market with about 45% market share. US is follower, accounting for about 19% market share.

The rise of e-commerce has further accelerated demand for packaging materials, contributing to the increasing production of paper products. Additionally, heightened environmental awareness has prompted manufacturers to adopt more sustainable practices, driving the need for caustic soda in recycling processes.

Industry Restraint

Volatility of raw material prices

One significant restraint in the caustic soda industry is the volatility of raw material prices, particularly for chlorine and sodium chloride, which are critical inputs in the production of caustic soda. Fluctuations in the prices of these raw materials can directly impact production costs, making it challenging for manufacturers to maintain stable pricing and profit margins. Various factors contribute to this volatility, including geopolitical tensions, supply chain disruptions, and changes in demand dynamics. For instance, events such as natural disasters, trade restrictions, or changes in regulations can lead to shortages or price hikes, which can ripple through the entire supply chain.

The production process of caustic soda has been energy intestine, and the reduction in production and the disruption in supply chain because of the Russia Ukraine war led to the increase in the energy price which acts a major challenges for the industry growth. Furthermore, the increasing energy price had led to the increased plastic cost production thereby leading to decline in demand for chlorine and substantially affecting the supply of caustic soda which as an key components in the chlorine manufacturing process. Moreover, the pandemic cause by the emergence of COVID 19 also lead to the significant declining demand from the downstream market related to the product, except from some products industry such as water treatment, bleaching industry etc. the production cut in 2021 in the U.S the industry is still facing some shortage, also the regulatory policies and standards in some region and countries is also likely to challenge the market growth.

The restrain in the rate of production is likely to persist globally affecting the supply in 2024 as well which may be due to the expected increase in winter electricity cost. The operational rate for this product is expected to be lower in Europe because of the decline in demand for some chlorine derivatives.

Industry Trend

Shift towards sustainability and eco-friendly production practices

The move to eco-friendly and sustainable production methods is a major trend in the caustic soda sector. Manufacturers are concentrating more on minimizing the environmental impact of their operations as environmental regulations tighten and customer knowledge of sustainability issues rises. Investments in greener production techniques and technology that reduce waste creation and energy consumption are being driven by this trend.

Businesses are specifically looking into more energy-efficient ways to produce caustic soda, like improvements in electrolysis technology, which can reduce emissions and boost productivity. By lowering reliance on non-renewable resources, alternative feedstock’s and recycling techniques are also gaining popularity and can support a circular economy. The growing need for caustic soda in recycling applications, especially in the paper and textile sectors, is another noteworthy trend. Caustic soda is playing an increasingly important part in recycling operations as businesses look to create recyclable and sustainable products.

In addition, the market is seeing advancements in product applications and formulations that address particular consumer demands in industries like personal care, food processing, and pharmaceuticals. The caustic soda sector is positioned for sustained success in a market that is changing quickly because to its emphasis on sustainability, innovation, and product differentiation.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|