TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

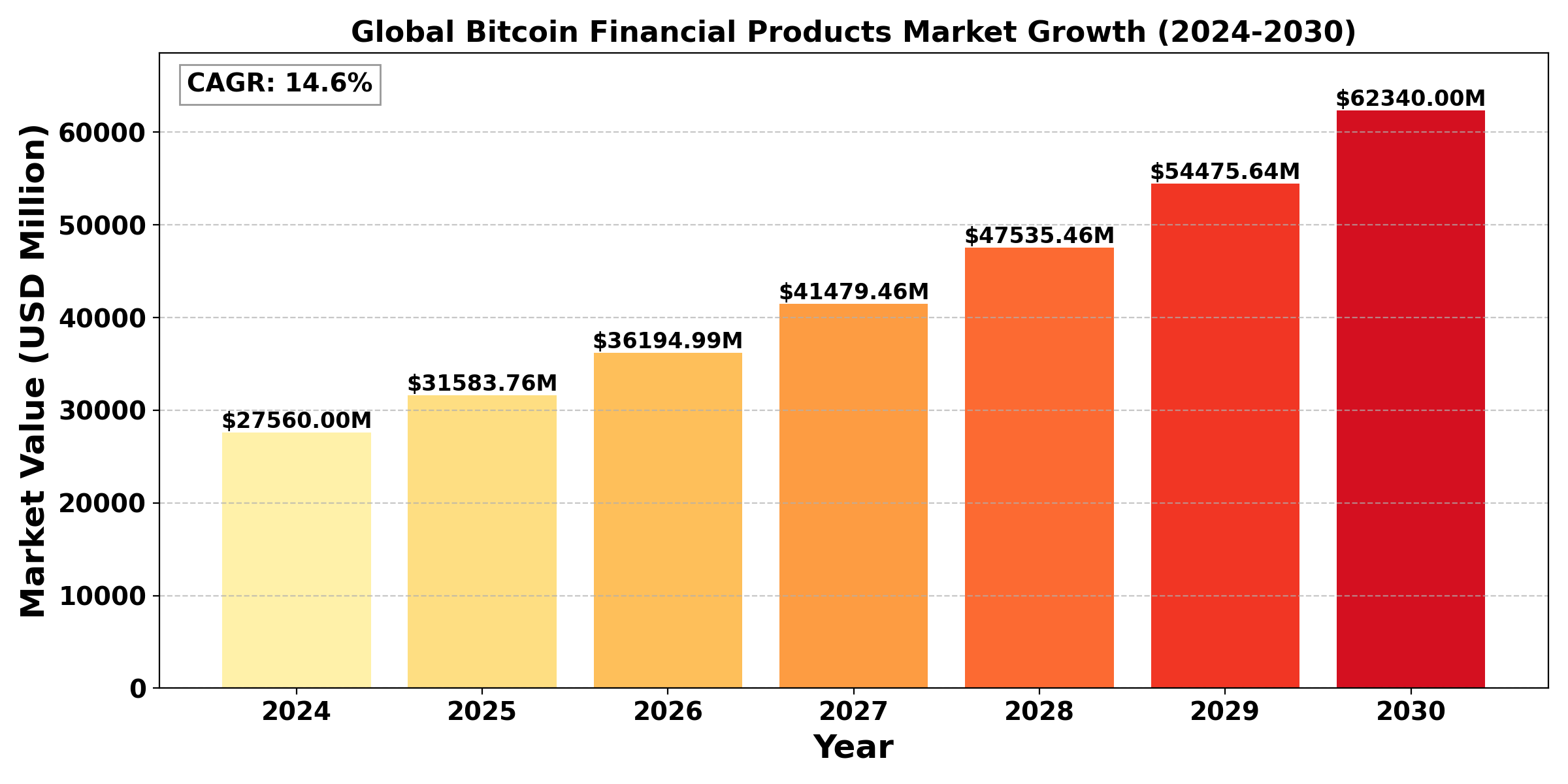

The "Global Bitcoin Financial Products Market" size was valued at US$ 27.56 billion in 2024 and is projected to reach US$ 62.34 billion by 2030, at a CAGR of 14.6% during the forecast period 2024-2030.

The "United States Bitcoin Financial Products Market" size was valued at US$ 9.82 billion in 2024 and is projected to reach US$ 22.45 billion by 2030, at a CAGR of 14.8% during the forecast period 2024-2030.

Bitcoin financial products encompass a range of investment tools designed to provide exposure to Bitcoin's price fluctuations. These include Exchange-Traded Funds (ETFs), futures, options, trusts, and derivatives, allowing both retail and institutional investors to engage with Bitcoin’s value indirectly. Such products help manage risk, facilitate portfolio diversification, and meet regulatory and custodial requirements for investors preferring not to hold Bitcoin directly.

Trading volume reached US$ 385 billion in 2023. ETF products grow at 20.2% annually. Market saw 85% increase in institutional participation. Regulations in 48 countries. Future developments worth US$ 14.23 billion by 2026. North America leads with 47% share.

Report Overview

Bitcoin is a kind of cryptocurrency based on decentralization, using peer-to-peer network and consensus initiative, open source, and blockchain as the underlying technology.

This report provides a deep insight into the global Bitcoin Financial Products market covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and accessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Bitcoin Financial Products Market, this report introduces in detail the market share, market performance, product situation, operation situation, etc. of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Bitcoin Financial Products market in any manner.

Global Bitcoin Financial Products Market: Market Segmentation Analysis

The research report includes specific segments by region (country), manufacturers, Type, and Application. Market segmentation creates subsets of a market based on product type, end-user or application, Geographic, and other factors. By understanding the market segments, the decision-maker can leverage this targeting in the product, sales, and marketing strategies. Market segments can power your product development cycles by informing how you create product offerings for different segments.

Key Company