Industry Overview

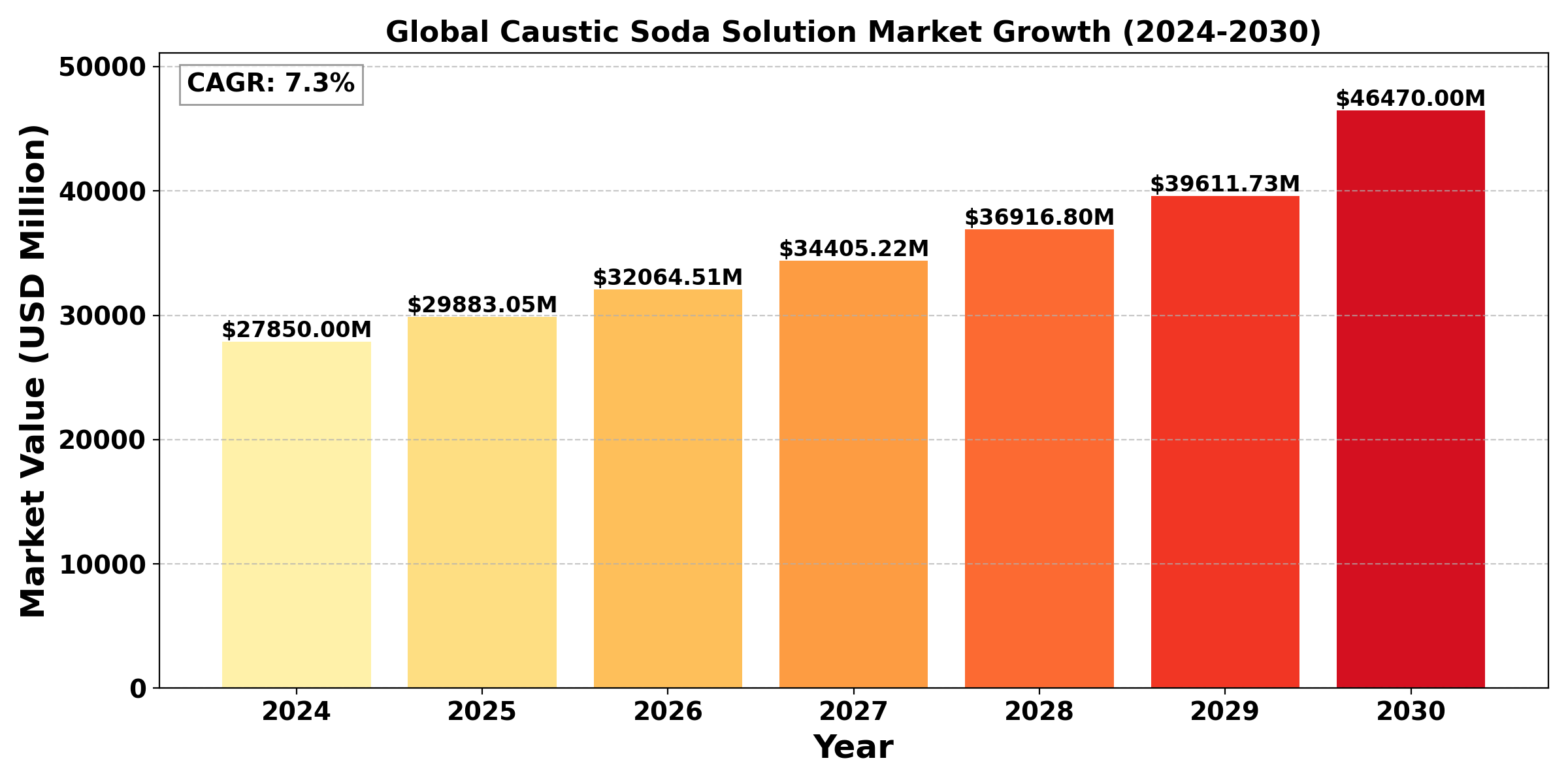

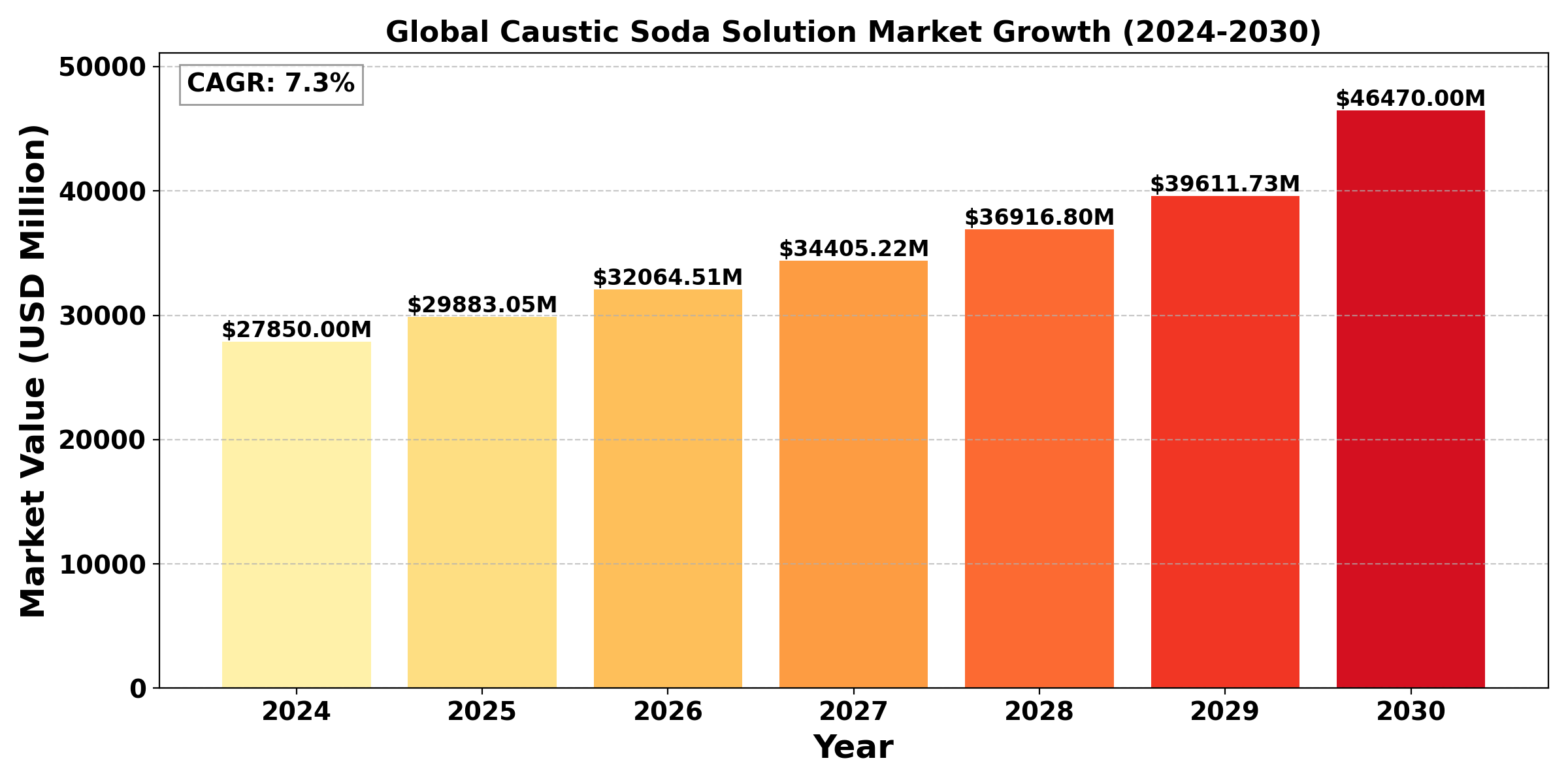

The "Global Caustic Soda Solution Market" was valued at US$ 27.85 Billion in 2024 and is projected to reach US$ 46.47 Billion by 2030, at a CAGR of 7.3% during the forecast period.

The Caustic Soda industry holds a significant part in the global chemical industry, this chemical plays an import role in application in diverse application across various end use industries. Chemically know as Sodium Hydroxide (NaOH), caustic soda holds exceptionally versatile application in various profound industrial significance, underpinning its widespread adoption and integral role in various sectors.

The Caustic Soda is produced through the electrolyzing brian in which a solution of sodium chloride is mixed in water, which leads to the yield of hydrogen gas, chlorine gas and the coveted caustic soda itself. The industry usually utilizes two main process in the production process I,e the mercury cell process and the membrane cell process. The mercury cell production has been significantly diminishing use has been less in use because of the environment hazardous that comes with it. However, the membrane cell process, is widely embraced for its superior environmental credentials utilizing ion-exchange membranes to separate chlorine and caustic soda efficiently.

The Caustic Soda holds a diverse application in various industry. In the Paper and pulp industry and acts as a linchpin for the pulping and bleaching processes, which leads to the transformation of raw material in a high quality paper product. Also, in the textile industry, the caustic soda holds a significant use in the fabric processing and bleaching leading to vibrant hues and enhancing the durability of textiles worldwide. Furthermore, the Caustic soda also serves as a fundamental ingredient in the production of array of chemical in such as soaps, detergents, to solvents and pharmaceutical ingredient, highlighting its significant role in the daily used products and different industrial process.

The Industrial dynamic for the caustic soda is influenced by various factors which includes the demand and supply dynamics in the end use industry ,the end use industrial growth, the fluctuation in price of raw materials, the availability of raw materials, supply chain dynamics etc. Furthermore, the industry is also poised by certain challenges such as the environmental concern from the production of chlorine gas emission during the production and energy-intensive processes underscore the industry's ongoing quest for sustainability and efficiency.

Segmental Analysis

30-54% to hold the highest market share: By Type

The 30–54% concentration group has the largest market share in the global caustic soda solution market. Because it strikes a balance between effectiveness and adaptability, this concentration range is the most widely utilized and can be used to a variety of industries. This concentration is preferred by industries like chemical manufacture, pulp & paper, textiles, water treatment, and aluminum processing because it offers potent caustic qualities while remaining safe and economical. This concentration is also preferred due to its effectiveness in neutralizing acids, regulating pH levels, and decomposing organic compounds, which makes it essential in a variety of industrial applications. The 30–54% caustic soda solution is widely used in various industries, which has led to its market domination.

The other segments, such as 10-30% and Others, which include concentrations above 54%, typically serve more niche or specialized applications. For instance, lower concentrations (10-30%) are often utilized in less aggressive cleaning applications or as a pH adjuster, while higher concentrations are reserved for industries that require greater causticity, such as certain metallurgical and chemical synthesis processes.

Pulp and Paper to hold the highest market share: By Application

The pulp and paper sector has the largest market share by application in the global market for caustic soda solutions. This dominance results from caustic soda's crucial involvement in the bleaching and pulping processes, which are necessary to the manufacturing of paper. In order to separate the cellulose fibers from the lignin in wood and turn raw wood into pulp, caustic soda is essential. It is an essential chemical in the creation of premium paper goods because of its alkaline qualities, which also aid in dissolving contaminants and enhancing pulp color.

In the pulp and paper sector, caustic soda is still in high demand because of the global expansion of packaging and tissue paper demand, which is being fueled by e-commerce, growing paper consumption, and hygiene awareness. Although caustic soda is used for a variety of reasons by other industries such as textiles, soap and detergent manufacturing, and chemical processing, their consumption is not as high as that of the pulp and paper sector. Pulp & paper is the industry category that consumes the most caustic soda solution due to its extensive use within the sector and its growth trajectory.

Regional Overview

The demand factors and trends in the global market for caustic soda solution vary by region. Applications in the pulp and paper, chemical processing, and water treatment sectors are the main drivers of the stable demand in North America and Europe, which are established markets. Strict environmental laws in these areas have an impact on manufacturing techniques and encourage the development of innovative sustainable production methods. In contrast, Asia-Pacific is the market with the quickest rate of growth because to the fast industrialization and rising demand from sectors like paper, aluminum processing, and textiles in nations like China and India. The region is now a global leader in demand for caustic soda because to its thriving manufacturing sector and infrastructure expenditures.

Growth in Latin America is steady but moderate, especially in nations like Brazil and Mexico where the growing chemical, pulp and paper, and petroleum industries heavily rely on caustic soda. As industrialization picks up speed, demand in growing countries like the Middle East and Africa is rising, especially in the areas of water treatment and aluminum manufacturing. Due to its industrial base, Asia-Pacific dominates the market overall. North America and Europe follow, where market dynamics are influenced by an emphasis on innovation and environmental compliance.

Competitive Analysis

- Westlake (Axiall)

- OxyChem

- Dow

- Olin Corporation

- Tosoh

- INEOS

- AGC Inc.

- Covestro

- Hanwha Chemical

- LG Chemical

- Tokuyama Corp

- Kemira

- Aditya Birla Chemicals

- GACL

- ChemChina

- Other Key Players

The global caustic soda solution market is highly competitive, with both established players and emerging companies vying for market share. Major players, including Olin Corporation, Westlake Chemical Corporation, Tata Chemicals, Dow Chemical Company, and Occidental Petroleum Corporation, dominate the market, leveraging their extensive distribution networks, strong brand reputation, and large production capacities. These companies benefit from economies of scale, allowing them to maintain competitive pricing and secure long-term contracts with key customers in industries like pulp and paper, chemical processing, and water treatment.

Recent Development

➣ In, 2022, The chemical division of Occidental Petroleum Corporation made the decision to investigate renovating a few chlor-alkali plants in order to boost output of caustic soda with a higher value and satisfy the company's expanding need for its main goods.

➣ In 2023, Covestro and Lanxess partnered to create raw materials that are more environmentally friendly and have a lower carbon footprint.

End Use Industry Analysis

The global caustic soda solution market is driven by diverse end-use industries, each with specific demands that shape overall market dynamics. A significant consumer is pulp & paper, which uses caustic soda extensively for fiber processing, bleaching, and pulping. The rise of this industry, which is driven by an increase in the need for hygiene goods and packaging, supports the steady demand for caustic soda. Another important sector is the chemical processing business, where caustic soda is essential for the production of different chemicals, such as solvents, polymers, and synthetic fibers. Because of the wide range of applications across industries, this sector offers stability to the market.

The market for caustic soda in textiles is expanding, especially in the areas of fabric processing, dyeing, and finishing. Global textile output, particularly in Asia-Pacific, is driving significant demand growth in this market. Caustic soda is used in the saponification process, which turns fats and oils into soap, in the production of soap and detergents. The growing emphasis on cleanliness and hygiene around the world is advantageous to this market. Aluminum processing also drives demand, as caustic soda is essential in refining bauxite into alumina, an intermediate in aluminum production. The expansion of the automobile and construction industries, especially in emerging nations, is linked to this demand.

The demand for caustic soda is also influenced by other sectors, such as water treatment and petroleum refining. It helps control pH levels and treat waste in water treatment, and it is used to eliminate sulfur and other impurities from petroleum. Overall, the market for caustic soda is resilient due to the variety of end-use sectors, as demand in one sector can counteract changes in another, supporting steady global expansion.

Industry Dynamics

Industry Drivers

Increasing demand from the pulp and paper industry

The growing demand from the pulp and paper sector is one of the main factors propelling the market for caustic soda solution. The increasing need for hygienic products and ecological packaging options, especially in light of the growing e-commerce trend, is driving this industry's comeback. The pulp and paper industry is adjusting by employing caustic soda to increase the production of recyclable materials as consumer preferences shift toward eco-friendly products. In order to create high-quality pulp for a variety of paper goods, such as tissue, packaging, and printing paper, caustic soda is essential to the pulping process. It does this by dissolving lignin and separating cellulose fibers. The continuous growth of the pulp and paper industry also increases the demand for caustic soda, making it an essential component in the production of essential paper goods and supporting the market's overall expansion. Technological and production process advancements are also allowing paper manufacturers to optimize their use of caustic soda, improving efficiency and lowering costs. Additionally, global efforts to reduce plastic usage further amplify the need for paper-based alternatives, driving increased investments in the pulp and paper sector.

Industry Trend

Shift towards sustainable and eco-friendly production practices

The move toward environmentally friendly and sustainable production methods is one notable development in the market for caustic soda solutions. Manufacturers are concentrating on lowering the carbon footprint related to the manufacturing of caustic soda as environmental concerns and regulatory demands grow on a global scale. Growing awareness of the negative environmental effects of conventional industrial techniques, which frequently rely significantly on energy-intensive procedures and increase greenhouse gas emissions, is what is driving this movement.

To address these concerns, companies are investing in more energy-efficient technologies and exploring alternative production methods, such as the electrolysis of brine, which offers lower emissions compared to conventional methods. Additionally, there is a rising interest in developing bio-based or less harmful alternatives to caustic soda for specific applications, particularly in industries like textiles and food processing, where sustainability is becoming a key purchasing criterion. Businesses are investigating alternate manufacturing techniques, such electrolyzing brine, which offers lower emissions than traditional methods, and investing in more energy-efficient equipment to allay these worries. Furthermore, there is growing interest in creating bio-based or less hazardous substitutes for caustic soda for certain uses, especially in sectors like food processing and textiles.

Industry Restraint

Price Volatile of Raw Material

Price volatility for raw materials, especially sodium hydroxide and chlorine, which are necessary for the production of caustic soda solution, is one of the main factors limiting the market for this product. These raw materials' cost and availability are directly related to the production of caustic soda, and changes in their price can have a big effect on the total cost of production. The pricing structure of caustic soda can be impacted by factors such supply chain disruptions, trade policy changes, and geopolitical tensions that raise the cost of raw materials.

Concerns regarding sustainability and regulatory compliance are also raised by the industrial process's dependency on fossil fuels and non-renewable resources. Manufacturers may have to make more operational adjustments and pay higher compliance costs as governments throughout the world impose stronger environmental rules, which might put more pressure on profit margins.

Furthermore, a competitive challenge that can restrict market expansion is the appearance of substitute materials and chemicals that can be used in place of caustic soda in particular applications. Businesses must balance the need for sustainable and affordable solutions with these difficulties, therefore they must create plans that reduce the risks brought on by fluctuating raw material prices and regulatory demands.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes

|

Details

|

|

Segments

|

By Type

By Application

- Pulp and Paper

- Textiles

- Soap and Detergents

- Bleach Manufacturing

- Petroleum Products

- Aluminum Processing

- Chemical Processing

- Other

|

|

Region Covered

|

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South Africa

|

|

Key Market Players

|

- Westlake (Axiall)

- OxyChem

- Dow

- Olin Corporation

- Tosoh

- INEOS

- AGC Inc.

- Covestro

- Hanwha Chemical

- LG Chemical

- Tokuyama Corp

- Kemira

- Aditya Birla Chemicals

- GACL

- ChemChina

- Other Key Players

|

|

Report Coverage

|

- Industry Trends

- SWOT Analysis

- PESTEL Analysis

- Porter’s Five Forces Analysis

- Market Competition by Manufacturers

- Key Companies Profiled

- Marketing Channel, Distributors and Customers

- Market Dynamics

- Production and Supply Forecast

- Demand Forecast

- Research Findings and Conclusion

|

TABLE OF CONTENTS

1 Introduction to Research & Analysis Reports

1.1 Caustic Soda Solution Market Definition

1.2 Market Segments

1.2.1 Market by Type

1.2.2 Market by Application

1.3 Global Caustic Soda Solution Market Overview

1.4 Features & Benefits of This Report

1.5 Methodology & Sources of Information

1.5.1 Research Methodology

1.5.2 Research Process

1.5.3 Base Year

1.5.4 Report Assumptions & Caveats

2 Global Caustic Soda Solution Overall Market Size

2.1 Global Caustic Soda Solution Market Size: 2023 VS 2030

2.2 Global Caustic Soda Solution Revenue, Prospects & Forecasts: 2019-2030

2.3 Global Caustic Soda Solution Sales: 2019-2030

3 Company Landscape

3.1 Top Caustic Soda Solution Players in Global Market

3.2 Top Global Caustic Soda Solution Companies Ranked by Revenue

3.3 Global Caustic Soda Solution Revenue by Companies

3.4 Global Caustic Soda Solution Sales by Companies

3.5 Global Caustic Soda Solution Price by Manufacturer (2019-2024)

3.6 Top 3 and Top 5 Caustic Soda Solution Companies in Global Market, by Revenue in 2023

3.7 Global Manufacturers Caustic Soda Solution Product Type

3.8 Tier 1, Tier 2 and Tier 3 Caustic Soda Solution Players in Global Market

3.8.1 List of Global Tier 1 Caustic Soda Solution Companies

3.8.2 List of Global Tier 2 and Tier 3 Caustic Soda Solution Companies

4 Sights by Product

4.1 Overview

4.1.1 By Type - Global Caustic Soda Solution Market Size Markets, 2023 & 2030

4.1.2 10-30%

4.1.3 30-54%

4.1.4 Others

4.2 By Type - Global Caustic Soda Solution Revenue & Forecasts

4.2.1 By Type - Global Caustic Soda Solution Revenue, 2019-2024

4.2.2 By Type - Global Caustic Soda Solution Revenue, 2025-2030

4.2.3 By Type - Global Caustic Soda Solution Revenue Market Share, 2019-2030

4.3 By Type - Global Caustic Soda Solution Sales & Forecasts

4.3.1 By Type - Global Caustic Soda Solution Sales, 2019-2024

4.3.2 By Type - Global Caustic Soda Solution Sales, 2025-2030

4.3.3 By Type - Global Caustic Soda Solution Sales Market Share, 2019-2030

4.4 By Type - Global Caustic Soda Solution Price (Manufacturers Selling Prices), 2019-2030

5 Sights by Application

5.1 Overview

5.1.1 By Application - Global Caustic Soda Solution Market Size, 2023 & 2030

5.1.2 Pulp and Paper

5.1.3 Textiles

5.1.4 Soap and Detergents

5.1.5 Bleach Manufacturing

5.1.6 Petroleum Products

5.1.7 Aluminum Processing

5.1.8 Chemical Processing

5.1.9 Other

5.2 By Application - Global Caustic Soda Solution Revenue & Forecasts

5.2.1 By Application - Global Caustic Soda Solution Revenue, 2019-2024

5.2.2 By Application - Global Caustic Soda Solution Revenue, 2025-2030

5.2.3 By Application - Global Caustic Soda Solution Revenue Market Share, 2019-2030

5.3 By Application - Global Caustic Soda Solution Sales & Forecasts

5.3.1 By Application - Global Caustic Soda Solution Sales, 2019-2024

5.3.2 By Application - Global Caustic Soda Solution Sales, 2025-2030

5.3.3 By Application - Global Caustic Soda Solution Sales Market Share, 2019-2030

5.4 By Application - Global Caustic Soda Solution Price (Manufacturers Selling Prices), 2019-2030

6 Sights by Region

6.1 By Region - Global Caustic Soda Solution Market Size, 2023 & 2030

6.2 By Region - Global Caustic Soda Solution Revenue & Forecasts

6.2.1 By Region - Global Caustic Soda Solution Revenue, 2019-2024

6.2.2 By Region - Global Caustic Soda Solution Revenue, 2025-2030

6.2.3 By Region - Global Caustic Soda Solution Revenue Market Share, 2019-2030

6.3 By Region - Global Caustic Soda Solution Sales & Forecasts

6.3.1 By Region - Global Caustic Soda Solution Sales, 2019-2024

6.3.2 By Region - Global Caustic Soda Solution Sales, 2025-2030

6.3.3 By Region - Global Caustic Soda Solution Sales Market Share, 2019-2030

6.4 North America

6.4.1 By Country - North America Caustic Soda Solution Revenue, 2019-2030

6.4.2 By Country - North America Caustic Soda Solution Sales, 2019-2030

6.4.3 US Caustic Soda Solution Market Size, 2019-2030

6.4.4 Canada Caustic Soda Solution Market Size, 2019-2030

6.4.5 Mexico Caustic Soda Solution Market Size, 2019-2030

6.5 Europe

6.5.1 By Country - Europe Caustic Soda Solution Revenue, 2019-2030

6.5.2 By Country - Europe Caustic Soda Solution Sales, 2019-2030

6.5.3 Germany Caustic Soda Solution Market Size, 2019-2030

6.5.4 France Caustic Soda Solution Market Size, 2019-2030

6.5.5 U.K. Caustic Soda Solution Market Size, 2019-2030

6.5.6 Italy Caustic Soda Solution Market Size, 2019-2030

6.5.7 Russia Caustic Soda Solution Market Size, 2019-2030

6.5.8 Nordic Countries Caustic Soda Solution Market Size, 2019-2030

6.5.9 Benelux Caustic Soda Solution Market Size, 2019-2030

6.6 Asia

6.6.1 By Region - Asia Caustic Soda Solution Revenue, 2019-2030

6.6.2 By Region - Asia Caustic Soda Solution Sales, 2019-2030

6.6.3 China Caustic Soda Solution Market Size, 2019-2030

6.6.4 Japan Caustic Soda Solution Market Size, 2019-2030

6.6.5 South Korea Caustic Soda Solution Market Size, 2019-2030

6.6.6 Southeast Asia Caustic Soda Solution Market Size, 2019-2030

6.6.7 India Caustic Soda Solution Market Size, 2019-2030

6.7 South America

6.7.1 By Country - South America Caustic Soda Solution Revenue, 2019-2030

6.7.2 By Country - South America Caustic Soda Solution Sales, 2019-2030

6.7.3 Brazil Caustic Soda Solution Market Size, 2019-2030

6.7.4 Argentina Caustic Soda Solution Market Size, 2019-2030

6.8 Middle East & Africa

6.8.1 By Country - Middle East & Africa Caustic Soda Solution Revenue, 2019-2030

6.8.2 By Country - Middle East & Africa Caustic Soda Solution Sales, 2019-2030

6.8.3 Turkey Caustic Soda Solution Market Size, 2019-2030

6.8.4 Israel Caustic Soda Solution Market Size, 2019-2030

6.8.5 Saudi Arabia Caustic Soda Solution Market Size, 2019-2030

6.8.6 UAE Caustic Soda Solution Market Size, 2019-2030

7 Manufacturers & Brands Profiles

7.1 Westlake (Axiall)

7.1.1 Westlake (Axiall) Company Summary

7.1.2 Westlake (Axiall) Business Overview

7.1.3 Westlake (Axiall) Caustic Soda Solution Major Product Offerings

7.1.4 Westlake (Axiall) Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.1.5 Westlake (Axiall) Key News & Latest Developments

7.2 OxyChem

7.2.1 OxyChem Company Summary

7.2.2 OxyChem Business Overview

7.2.3 OxyChem Caustic Soda Solution Major Product Offerings

7.2.4 OxyChem Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.2.5 OxyChem Key News & Latest Developments

7.3 Dow

7.3.1 Dow Company Summary

7.3.2 Dow Business Overview

7.3.3 Dow Caustic Soda Solution Major Product Offerings

7.3.4 Dow Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.3.5 Dow Key News & Latest Developments

7.4 Olin Corporation

7.4.1 Olin Corporation Company Summary

7.4.2 Olin Corporation Business Overview

7.4.3 Olin Corporation Caustic Soda Solution Major Product Offerings

7.4.4 Olin Corporation Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.4.5 Olin Corporation Key News & Latest Developments

7.5 Tosoh

7.5.1 Tosoh Company Summary

7.5.2 Tosoh Business Overview

7.5.3 Tosoh Caustic Soda Solution Major Product Offerings

7.5.4 Tosoh Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.5.5 Tosoh Key News & Latest Developments

7.6 INEOS

7.6.1 INEOS Company Summary

7.6.2 INEOS Business Overview

7.6.3 INEOS Caustic Soda Solution Major Product Offerings

7.6.4 INEOS Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.6.5 INEOS Key News & Latest Developments

7.7 AGC Inc.

7.7.1 AGC Inc. Company Summary

7.7.2 AGC Inc. Business Overview

7.7.3 AGC Inc. Caustic Soda Solution Major Product Offerings

7.7.4 AGC Inc. Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.7.5 AGC Inc. Key News & Latest Developments

7.8 Covestro

7.8.1 Covestro Company Summary

7.8.2 Covestro Business Overview

7.8.3 Covestro Caustic Soda Solution Major Product Offerings

7.8.4 Covestro Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.8.5 Covestro Key News & Latest Developments

7.9 Hanwha Chemical

7.9.1 Hanwha Chemical Company Summary

7.9.2 Hanwha Chemical Business Overview

7.9.3 Hanwha Chemical Caustic Soda Solution Major Product Offerings

7.9.4 Hanwha Chemical Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.9.5 Hanwha Chemical Key News & Latest Developments

7.10 LG Chemical

7.10.1 LG Chemical Company Summary

7.10.2 LG Chemical Business Overview

7.10.3 LG Chemical Caustic Soda Solution Major Product Offerings

7.10.4 LG Chemical Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.10.5 LG Chemical Key News & Latest Developments

7.11 Tokuyama Corp

7.11.1 Tokuyama Corp Company Summary

7.11.2 Tokuyama Corp Caustic Soda Solution Business Overview

7.11.3 Tokuyama Corp Caustic Soda Solution Major Product Offerings

7.11.4 Tokuyama Corp Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.11.5 Tokuyama Corp Key News & Latest Developments

7.12 Kemira

7.12.1 Kemira Company Summary

7.12.2 Kemira Caustic Soda Solution Business Overview

7.12.3 Kemira Caustic Soda Solution Major Product Offerings

7.12.4 Kemira Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.12.5 Kemira Key News & Latest Developments

7.13 Aditya Birla Chemicals

7.13.1 Aditya Birla Chemicals Company Summary

7.13.2 Aditya Birla Chemicals Caustic Soda Solution Business Overview

7.13.3 Aditya Birla Chemicals Caustic Soda Solution Major Product Offerings

7.13.4 Aditya Birla Chemicals Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.13.5 Aditya Birla Chemicals Key News & Latest Developments

7.14 GACL

7.14.1 GACL Company Summary

7.14.2 GACL Business Overview

7.14.3 GACL Caustic Soda Solution Major Product Offerings

7.14.4 GACL Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.14.5 GACL Key News & Latest Developments

7.15 ChemChina

7.15.1 ChemChina Company Summary

7.15.2 ChemChina Business Overview

7.15.3 ChemChina Caustic Soda Solution Major Product Offerings

7.15.4 ChemChina Caustic Soda Solution Sales and Revenue in Global (2019-2024)

7.15.5 ChemChina Key News & Latest Developments

8 Global Caustic Soda Solution Production Capacity, Analysis

8.1 Global Caustic Soda Solution Production Capacity, 2019-2030

8.2 Caustic Soda Solution Production Capacity of Key Manufacturers in Global Market

8.3 Global Caustic Soda Solution Production by Region

9 Key Market Trends, Opportunity, Drivers and Restraints

9.1 Market Opportunities & Trends

9.2 Market Drivers

9.3 Market Restraints

10 Caustic Soda Solution Supply Chain Analysis

10.1 Caustic Soda Solution Industry Value Chain

10.2 Caustic Soda Solution Upstream Market

10.3 Caustic Soda Solution Downstream and Clients

10.4 Marketing Channels Analysis

10.4.1 Marketing Channels

10.4.2 Caustic Soda Solution Distributors and Sales Agents in Global

11 Conclusion

12 Appendix

12.1 Note

12.2 Examples of Clients

12.3 Disclaimer

LIST OF TABLES & FIGURES

List of Tables

Table 1. Key Players of Caustic Soda Solution in Global Market

Table 2. Top Caustic Soda Solution Players in Global Market, Ranking by Revenue (2023)

Table 3. Global Caustic Soda Solution Revenue by Companies, (US$, Mn), 2019-2024

Table 4. Global Caustic Soda Solution Revenue Share by Companies, 2019-2024

Table 5. Global Caustic Soda Solution Sales by Companies, (Tons), 2019-2024

Table 6. Global Caustic Soda Solution Sales Share by Companies, 2019-2024

Table 7. Key Manufacturers Caustic Soda Solution Price (2019-2024) & (US$/Ton)

Table 8. Global Manufacturers Caustic Soda Solution Product Type

Table 9. List of Global Tier 1 Caustic Soda Solution Companies, Revenue (US$, Mn) in 2023 and Market Share

Table 10. List of Global Tier 2 and Tier 3 Caustic Soda Solution Companies, Revenue (US$, Mn) in 2023 and Market Share

Table 11. By Type ? Global Caustic Soda Solution Revenue, (US$, Mn), 2023 & 2030

Table 12. By Type - Global Caustic Soda Solution Revenue (US$, Mn), 2019-2024

Table 13. By Type - Global Caustic Soda Solution Revenue (US$, Mn), 2025-2030

Table 14. By Type - Global Caustic Soda Solution Sales (Tons), 2019-2024

Table 15. By Type - Global Caustic Soda Solution Sales (Tons), 2025-2030

Table 16. By Application ? Global Caustic Soda Solution Revenue, (US$, Mn), 2023 & 2030

Table 17. By Application - Global Caustic Soda Solution Revenue (US$, Mn), 2019-2024

Table 18. By Application - Global Caustic Soda Solution Revenue (US$, Mn), 2025-2030

Table 19. By Application - Global Caustic Soda Solution Sales (Tons), 2019-2024

Table 20. By Application - Global Caustic Soda Solution Sales (Tons), 2025-2030

Table 21. By Region ? Global Caustic Soda Solution Revenue, (US$, Mn), 2023 VS 2030

Table 22. By Region - Global Caustic Soda Solution Revenue (US$, Mn), 2019-2024

Table 23. By Region - Global Caustic Soda Solution Revenue (US$, Mn), 2025-2030

Table 24. By Region - Global Caustic Soda Solution Sales (Tons), 2019-2024

Table 25. By Region - Global Caustic Soda Solution Sales (Tons), 2025-2030

Table 26. By Country - North America Caustic Soda Solution Revenue, (US$, Mn), 2019-2024

Table 27. By Country - North America Caustic Soda Solution Revenue, (US$, Mn), 2025-2030

Table 28. By Country - North America Caustic Soda Solution Sales, (Tons), 2019-2024

Table 29. By Country - North America Caustic Soda Solution Sales, (Tons), 2025-2030

Table 30. By Country - Europe Caustic Soda Solution Revenue, (US$, Mn), 2019-2024

Table 31. By Country - Europe Caustic Soda Solution Revenue, (US$, Mn), 2025-2030

Table 32. By Country - Europe Caustic Soda Solution Sales, (Tons), 2019-2024

Table 33. By Country - Europe Caustic Soda Solution Sales, (Tons), 2025-2030

Table 34. By Region - Asia Caustic Soda Solution Revenue, (US$, Mn), 2019-2024

Table 35. By Region - Asia Caustic Soda Solution Revenue, (US$, Mn), 2025-2030

Table 36. By Region - Asia Caustic Soda Solution Sales, (Tons), 2019-2024

Table 37. By Region - Asia Caustic Soda Solution Sales, (Tons), 2025-2030

Table 38. By Country - South America Caustic Soda Solution Revenue, (US$, Mn), 2019-2024

Table 39. By Country - South America Caustic Soda Solution Revenue, (US$, Mn), 2025-2030

Table 40. By Country - South America Caustic Soda Solution Sales, (Tons), 2019-2024

Table 41. By Country - South America Caustic Soda Solution Sales, (Tons), 2025-2030

Table 42. By Country - Middle East & Africa Caustic Soda Solution Revenue, (US$, Mn), 2019-2024

Table 43. By Country - Middle East & Africa Caustic Soda Solution Revenue, (US$, Mn), 2025-2030

Table 44. By Country - Middle East & Africa Caustic Soda Solution Sales, (Tons), 2019-2024

Table 45. By Country - Middle East & Africa Caustic Soda Solution Sales, (Tons), 2025-2030

Table 46. Westlake (Axiall) Company Summary

Table 47. Westlake (Axiall) Caustic Soda Solution Product Offerings

Table 48. Westlake (Axiall) Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 49. Westlake (Axiall) Key News & Latest Developments

Table 50. OxyChem Company Summary

Table 51. OxyChem Caustic Soda Solution Product Offerings

Table 52. OxyChem Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 53. OxyChem Key News & Latest Developments

Table 54. Dow Company Summary

Table 55. Dow Caustic Soda Solution Product Offerings

Table 56. Dow Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 57. Dow Key News & Latest Developments

Table 58. Olin Corporation Company Summary

Table 59. Olin Corporation Caustic Soda Solution Product Offerings

Table 60. Olin Corporation Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 61. Olin Corporation Key News & Latest Developments

Table 62. Tosoh Company Summary

Table 63. Tosoh Caustic Soda Solution Product Offerings

Table 64. Tosoh Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 65. Tosoh Key News & Latest Developments

Table 66. INEOS Company Summary

Table 67. INEOS Caustic Soda Solution Product Offerings

Table 68. INEOS Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 69. INEOS Key News & Latest Developments

Table 70. AGC Inc. Company Summary

Table 71. AGC Inc. Caustic Soda Solution Product Offerings

Table 72. AGC Inc. Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 73. AGC Inc. Key News & Latest Developments

Table 74. Covestro Company Summary

Table 75. Covestro Caustic Soda Solution Product Offerings

Table 76. Covestro Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 77. Covestro Key News & Latest Developments

Table 78. Hanwha Chemical Company Summary

Table 79. Hanwha Chemical Caustic Soda Solution Product Offerings

Table 80. Hanwha Chemical Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 81. Hanwha Chemical Key News & Latest Developments

Table 82. LG Chemical Company Summary

Table 83. LG Chemical Caustic Soda Solution Product Offerings

Table 84. LG Chemical Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 85. LG Chemical Key News & Latest Developments

Table 86. Tokuyama Corp Company Summary

Table 87. Tokuyama Corp Caustic Soda Solution Product Offerings

Table 88. Tokuyama Corp Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 89. Tokuyama Corp Key News & Latest Developments

Table 90. Kemira Company Summary

Table 91. Kemira Caustic Soda Solution Product Offerings

Table 92. Kemira Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 93. Kemira Key News & Latest Developments

Table 94. Aditya Birla Chemicals Company Summary

Table 95. Aditya Birla Chemicals Caustic Soda Solution Product Offerings

Table 96. Aditya Birla Chemicals Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 97. Aditya Birla Chemicals Key News & Latest Developments

Table 98. GACL Company Summary

Table 99. GACL Caustic Soda Solution Product Offerings

Table 100. GACL Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 101. GACL Key News & Latest Developments

Table 102. ChemChina Company Summary

Table 103. ChemChina Caustic Soda Solution Product Offerings

Table 104. ChemChina Caustic Soda Solution Sales (Tons), Revenue (US$, Mn) and Average Price (US$/Ton) (2019-2024)

Table 105. ChemChina Key News & Latest Developments

Table 106. Caustic Soda Solution Production Capacity (Tons) of Key Manufacturers in Global Market, 2021-2024 (Tons)

Table 107. Global Caustic Soda Solution Capacity Market Share of Key Manufacturers, 2021-2024

Table 108. Global Caustic Soda Solution Production by Region, 2019-2024 (Tons)

Table 109. Global Caustic Soda Solution Production by Region, 2025-2030 (Tons)

Table 110. Caustic Soda Solution Market Opportunities & Trends in Global Market

Table 111. Caustic Soda Solution Market Drivers in Global Market

Table 112. Caustic Soda Solution Market Restraints in Global Market

Table 113. Caustic Soda Solution Raw Materials

Table 114. Caustic Soda Solution Raw Materials Suppliers in Global Market

Table 115. Typical Caustic Soda Solution Downstream

Table 116. Caustic Soda Solution Downstream Clients in Global Market

Table 117. Caustic Soda Solution Distributors and Sales Agents in Global Market

List of Figures

Figure 1. Caustic Soda Solution Segment by Type in 2023

Figure 2. Caustic Soda Solution Segment by Application in 2023

Figure 3. Global Caustic Soda Solution Market Overview: 2023

Figure 4. Key Caveats

Figure 5. Global Caustic Soda Solution Market Size: 2023 VS 2030 (US$, Mn)

Figure 6. Global Caustic Soda Solution Revenue, 2019-2030 (US$, Mn)

Figure 7. Caustic Soda Solution Sales in Global Market: 2019-2030 (Tons)

Figure 8. The Top 3 and 5 Players Market Share by Caustic Soda Solution Revenue in 2023

Figure 9. By Type - Global Caustic Soda Solution Revenue, (US$, Mn), 2023 & 2030

Figure 10. By Type - Global Caustic Soda Solution Revenue Market Share, 2019-2030

Figure 11. By Type - Global Caustic Soda Solution Sales Market Share, 2019-2030

Figure 12. By Type - Global Caustic Soda Solution Price (US$/Ton), 2019-2030

Figure 13. By Application - Global Caustic Soda Solution Revenue, (US$, Mn), 2023 & 2030

Figure 14. By Application - Global Caustic Soda Solution Revenue Market Share, 2019-2030

Figure 15. By Application - Global Caustic Soda Solution Sales Market Share, 2019-2030

Figure 16. By Application - Global Caustic Soda Solution Price (US$/Ton), 2019-2030

Figure 17. By Region - Global Caustic Soda Solution Revenue, (US$, Mn), 2023 & 2030

Figure 18. By Region - Global Caustic Soda Solution Revenue Market Share, 2019 VS 2023 VS 2030

Figure 19. By Region - Global Caustic Soda Solution Revenue Market Share, 2019-2030

Figure 20. By Region - Global Caustic Soda Solution Sales Market Share, 2019-2030

Figure 21. By Country - North America Caustic Soda Solution Revenue Market Share, 2019-2030

Figure 22. By Country - North America Caustic Soda Solution Sales Market Share, 2019-2030

Figure 23. US Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 24. Canada Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 25. Mexico Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 26. By Country - Europe Caustic Soda Solution Revenue Market Share, 2019-2030

Figure 27. By Country - Europe Caustic Soda Solution Sales Market Share, 2019-2030

Figure 28. Germany Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 29. France Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 30. U.K. Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 31. Italy Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 32. Russia Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 33. Nordic Countries Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 34. Benelux Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 35. By Region - Asia Caustic Soda Solution Revenue Market Share, 2019-2030

Figure 36. By Region - Asia Caustic Soda Solution Sales Market Share, 2019-2030

Figure 37. China Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 38. Japan Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 39. South Korea Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 40. Southeast Asia Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 41. India Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 42. By Country - South America Caustic Soda Solution Revenue Market Share, 2019-2030

Figure 43. By Country - South America Caustic Soda Solution Sales Market Share, 2019-2030

Figure 44. Brazil Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 45. Argentina Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 46. By Country - Middle East & Africa Caustic Soda Solution Revenue Market Share, 2019-2030

Figure 47. By Country - Middle East & Africa Caustic Soda Solution Sales Market Share, 2019-2030

Figure 48. Turkey Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 49. Israel Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 50. Saudi Arabia Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 51. UAE Caustic Soda Solution Revenue, (US$, Mn), 2019-2030

Figure 52. Global Caustic Soda Solution Production Capacity (Tons), 2019-2030

Figure 53. The Percentage of Production Caustic Soda Solution by Region, 2023 VS 2030

Figure 54. Caustic Soda Solution Industry Value Chain

Figure 55. Marketing Channels