Industry Overview

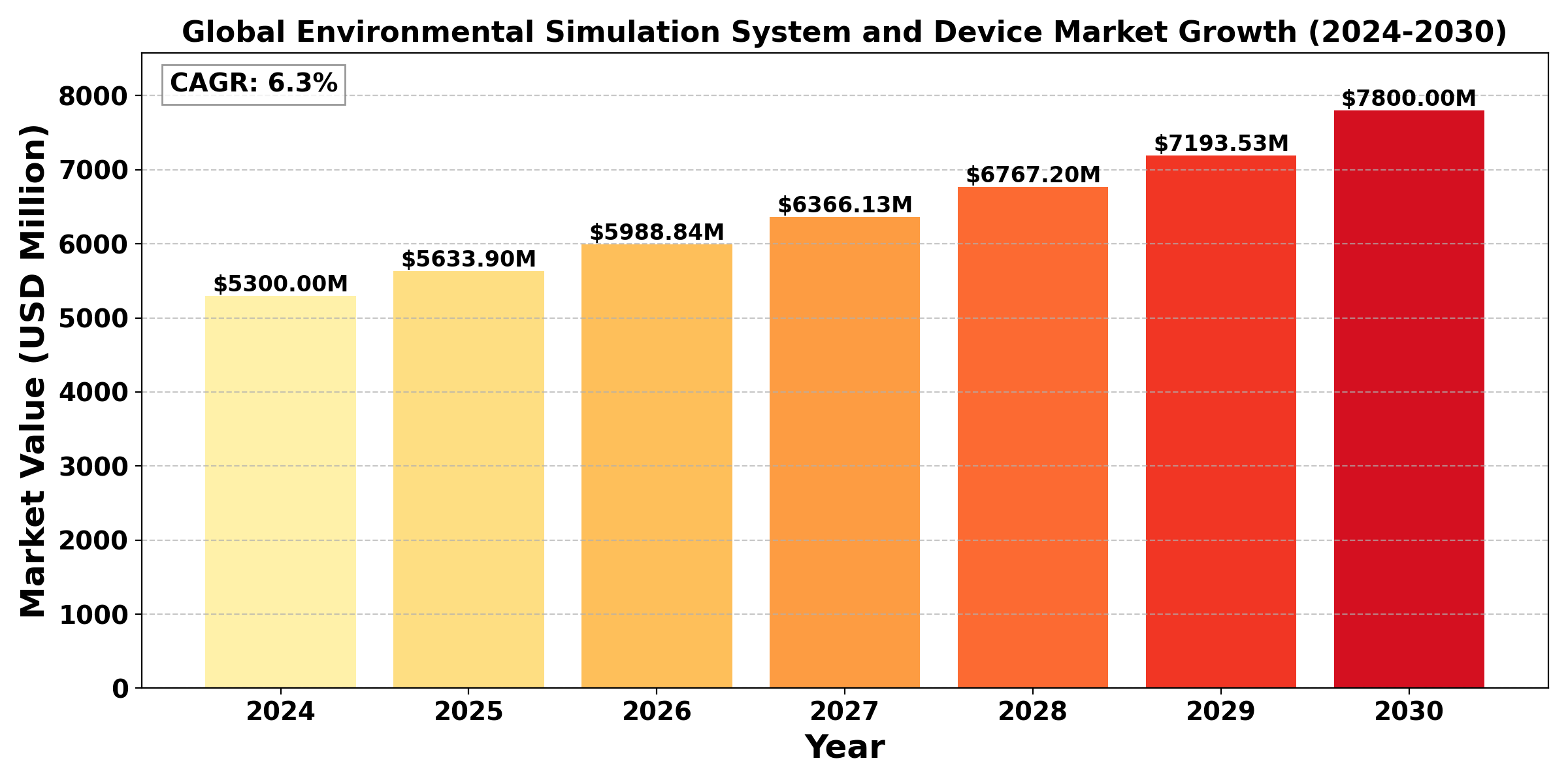

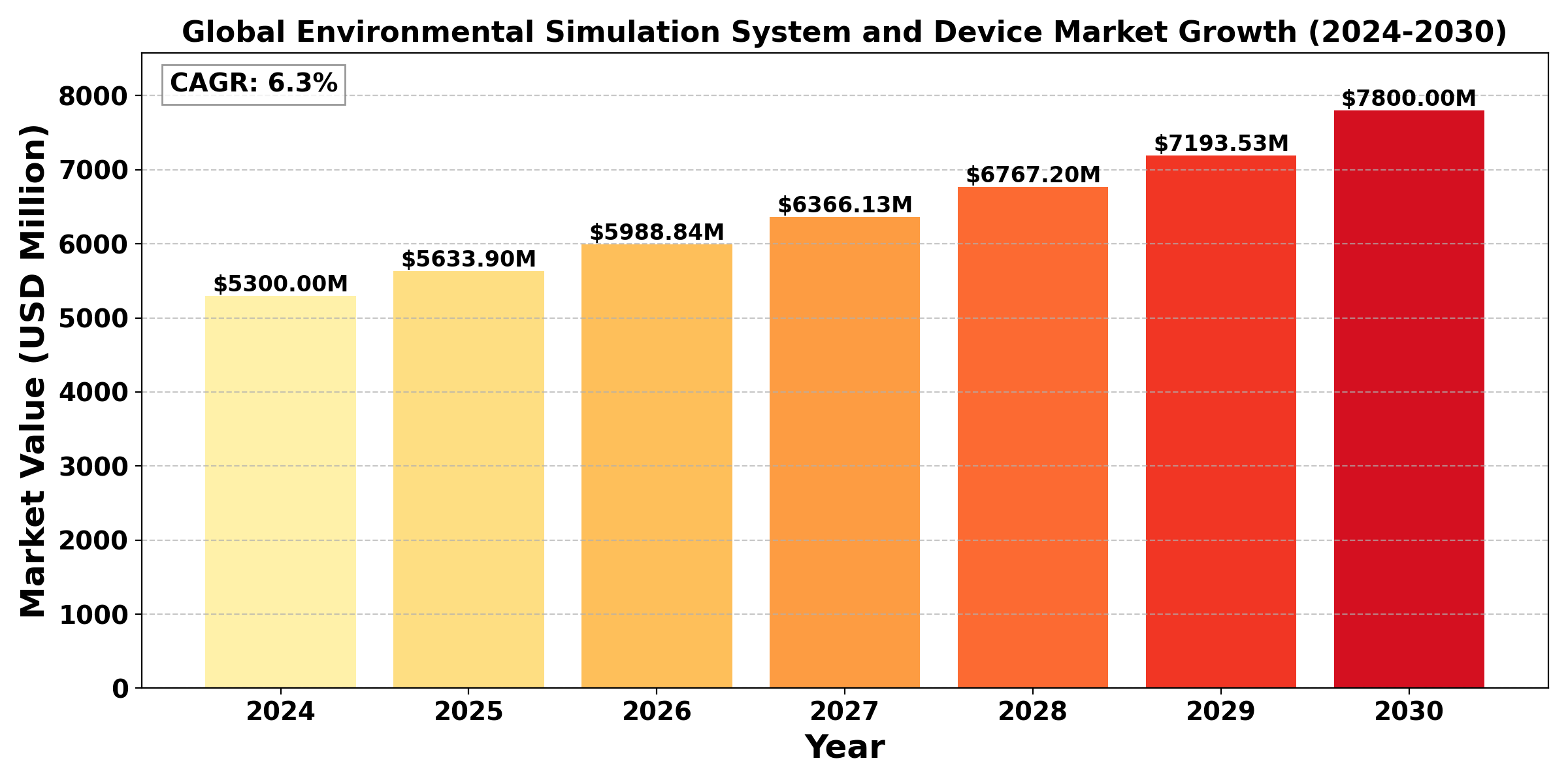

The "Global Environmental Simulation System and Device Market" was valued at US$ 5.3 Billion in 2024 and is projected to reach US$ 7.8 Billion by 2030, at a CAGR of 6.3% during the forecast period.

The market for environmental simulation systems and devices is expanding significantly due to increased demand from industries including electronics, automotive, and aerospace, where dependability and performance depend on testing goods in controlled environments. Manufacturers may assess the robustness and endurance of materials, parts, and products under harsh circumstances including temperature fluctuations, humidity, vibration, and pressure changes thanks to these systems, which include climatic, thermal, and shock simulation equipment. Technological developments like automated control systems, real-time data analytics, and Internet of Things-enabled monitoring are supporting the use of these simulation equipment and enabling more accurate and effective testing procedures. Adoption of these testing systems is also required by regulatory requirements for safety and quality standards in a variety of industries in order to guarantee compliance and enhance product quality.

Adoption of these testing systems is also required by regulatory requirements for safety and quality standards in a variety of industries in order to guarantee compliance and enhance product quality. Geographically, Asia-Pacific exhibits strong growth, driven by rising manufacturing activity and the expansion of the automotive and electronics sectors, while North America and Europe dominate the market due to substantial R&D investments and strict quality standards. As enterprises place a higher priority on product quality and dependability in the face of changing technical and regulatory environments, the market for environmental simulation systems and devices is expected to grow overall.

Segmental Analysis

Hardware Component to hold the highest market share: By Type

Hardware components have a larger market share than software in the global market for environmental simulation systems and devices. The crucial role that physical testing apparatus, such as temperature, humidity, and shock testing chambers, play in mimicking actual environmental conditions is primarily responsible for this domination. In sectors including electronics, automotive, and aerospace, hardware systems—such as vibration tables, climate chambers, and thermal shock chambers—are vital resources for evaluating the robustness and longevity of products. Furthermore, hardware often requires a larger upfront expenditure for purchase, maintenance, and upgrades than software, which helps explain why hardware accounts for a larger portion of market sales. However, software solutions are becoming more and more significant, particularly as they improve hardware performance's accuracy and efficiency through data analytics, automated control, and Internet of Things integration. Software is generally employed to supplement hardware systems rather than to replace them, even though it makes more complex data collection and analysis possible. As a result, hardware continues to be the more significant revenue category, and it is anticipated to increase significantly as more industries use sophisticated physical testing solutions for regulatory compliance and quality assurance.

Car Segment to hold the highest market share: By Application

The car application sector has the largest market share in the global environmental simulation system and device market. The strict testing requirements of the automotive industry, where manufacturers must guarantee vehicle safety, durability, and compliance with changing environmental laws, are partly responsible for its popularity. In order to ensure performance and dependability across a range of climates and terrains, automotive firms mostly rely on environmental simulation systems to test vehicles and parts under a variety of conditions, including severe temperatures, humidity, and vibration. The need for sophisticated testing to assess the resilience of novel vehicle technology and materials is growing as electric and driverless vehicles become more popular. Furthermore, regulatory agencies enforce stringent safety and quality requirements on automakers, which encourages the industry's use of environmental simulation tools. Automotive applications cover a wider range of testing needs across the entire vehicle, from structural components to electronic systems, giving this segment a more substantial share in the overall market, even though the electric and battery segments are also seeing significant growth as a result of the shift towards electrification.

Regional Analysis

North America and Europe hold the largest market shares in the global environmental simulation system and device market, which is growing at varying rates across different regions. North America, especially the United States, benefits from high R&D expenditures and stringent quality standards in sectors like electronics, automobiles, and aerospace. Advanced testing technologies are widely used in this region to assure product reliability and comply with regulatory requirements. Europe comes in second, thanks to its strict environmental laws and emphasis on environmentally friendly production methods, which increase demand for environmental testing equipment, especially in the electronics and automotive industries.

However, Asia-Pacific is the region with the highest rate of growth, mostly because of the booming manufacturing sector and the fast industrialization, particularly in China, Japan, and South Korea. As they serve high-standard international markets, these nations' automotive and electronics sectors are depending more and more on simulation systems for quality control. Additionally, it is projected that the demand for environmental testing equipment will increase as businesses in this area transition to electric vehicles and cutting-edge consumer gadgets. As their industries develop and are subject to more stringent quality and regulatory requirements, emerging economies in South America, the Middle East, and Africa are also progressively implementing these systems. All things considered, Asia-Pacific exhibits the most dynamic growth potential, even though North America and Europe lead.

Competitive Analysis

- IPG Automotive GmbH

- Weiss Technik

- NTS

- SGS

- Iwasaki Electric

- Dell Technologies

- Angstrom Engineering

- Horiba

- Element

- Stange Elektronik

- Other Key Players

Technological developments and the increasing demand for accurate testing in sectors including automotive, aerospace, electronics, and energy storage are driving intense competition in the environmental simulation system and device market. Prominent companies in the industry include ESPEC Corp., Thermotron Industries, Weiss Technik, and Angelantoni Test Technologies; they are all set apart by their emphasis on innovation, product variety, and customizability. For instance, ESPEC Corp. is a pioneer in environmental test chambers and is renowned for providing effective, high-quality solutions that are suited to a range of industry demands. Similarly, Thermotron targets industries with strict testing requirements, such aerospace and automotive, by offering complete testing systems that include temperature and vibration chambers.

Recent Development

July 21st, 2024, HORIBA announced the launch of its new compact hematology analyzers with combined ESR and CBC/Diff.

December 21, 2023, HORIBA STEC, Co., Ltd group company of the HORIBA Group leading the semi-conductor business, is to build a new factory in Fukuchiyama City, Kyoto Prefecture, to manufacture HORIBA Semiconductor's mainstay products such as mass flow controllers and chemical concentration monitors.

End Use Industry Analysis

The market for environmental simulation systems and devices is expected to rise steadily due to the growing demand for quality and reliability testing in vital sectors including energy storage, electronics, automotive, and aerospace. Manufacturers are depending more and more on environmental simulation systems to confirm that their goods are resilient to harsh environments like temperature fluctuations, vibration, and humidity as global standards for safety, durability, and environmental compliance becoming higher. Traditional testing methods are being transformed by the quick speed of technological improvements, such as IoT integration, real-time data analytics, and automated controls, which enable businesses to improve testing accuracy and expedite procedures. Furthermore, the industry's transition to sustainable practices is reflected in the drive for eco-friendly and energy-efficient testing solutions, which appeal to clients that care about the environment and are in line with international environmental standards.

Industry Dynamics

Industry Driver

Increasing Focus on Product Quality and Regulations

The growing focus on product quality and regulatory compliance across a range of industries is one of the main factors propelling the environmental simulation system and device market. Manufacturers are forced to implement strict testing procedures to make sure their products fulfil the increasingly demanding worldwide standards for performance, safety, and environmental sustainability. The stakes are especially high in industries like automotive, aircraft, electronics, and energy storage; goods must not only function dependably but also comply with laws governing their durability, safety, and influence on the environment.

For instance, the automotive industry must extensively test vehicles and components under simulated conditions that mimic real-world events due to the strict safety standards set by regulatory agencies. Manufacturers can assess how their products will react to extremes in temperature, humidity, vibration, and other environmental conditions by using environmental simulation systems. In the end, this capability reduces the danger of expensive recalls, legal penalties, and harm to brand reputation by guaranteeing that products can endure the demands of their intended applications and that they adhere to regulatory standards.

This demand has also been increased by the drive for sustainability, as businesses strive more and more to adhere to eco-friendly standards and show their dedication to lessening their influence on the environment. Manufacturers can carry out comprehensive testing that not only guarantees compliance but also fosters innovation in product design and materials by employing sophisticated environmental simulation systems. Investment in advanced testing technologies is fuelled by this simultaneous emphasis on regulatory compliance and quality assurance, which propels the market for environmental simulation and establishes it as a crucial part of contemporary manufacturing and quality control procedures.

Industry Restraint

High cost associated with acquiring and maintaining advanced testing equipment

One of the key restraints affecting the Environmental Simulation System and Device Market is the high cost associated with acquiring and maintaining advanced testing equipment. These simulation systems often require significant capital investment, which can be a barrier for small and medium-sized enterprises (SMEs) or startups that may not have the financial resources to invest in such technologies. Additionally, the complexity of these systems necessitates ongoing maintenance, calibration, and sometimes, specialized training for personnel to operate them effectively. Due to financial constraints brought on by these high operating costs, businesses may be forced to postpone purchases of essential testing tools or make trade-offs between the thoroughness and quality of their testing procedures. Because of this, some manufacturers might turn to antiquated or less advanced testing techniques, which raises the possibility of product failures, non-compliance with regulations, and eventually harm to their reputation.

Furthermore, businesses who have already made significant investments in outdated technologies may face difficulties due to the quick speed of technical improvements. Businesses may feel pressured to replace their equipment in order to stay competitive as new and improved testing methods appear, which could result in higher operating expenses. Companies may find it difficult to manage their current investments and stay up to date with innovation as a result of this dynamic, which could limit the market's overall growth for environmental simulations.

Industry Trend

The Environmental Simulation System and Device Market is witnessing several significant trends that are shaping its future landscape. The growing use of Internet of Things (IoT) technology into environmental testing systems is one notable development. Real-time monitoring and data collecting are made possible by IoT-enabled devices, which improves the accuracy and effectiveness of testing procedures. Manufacturers can streamline their testing processes and make faster, data-driven decisions thanks to this connectivity, which makes it easier to access test data remotely.

The increased emphasis on energy efficiency and sustainability is another trend. The need for environmentally friendly testing solutions is growing as companies are under more and more pressure to lessen their environmental impact. In line with larger corporate sustainability objectives, manufacturers are creating simulation systems that use sustainable materials and reduce energy consumption.The need for specialist environmental testing is also being driven by the move to electric vehicles (EVs) and sophisticated electronics. To guarantee performance and safety, components must be rigorously tested in a variety of environmental settings as these technologies advance. As a result, businesses are spending money on sophisticated simulation programs designed to address the particular difficulties presented by these new technologies.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes

|

Details

|

|

Segments

|

By Type

By Application

- Car

- Electric

- Battery

- Other

|

|

Region Covered

|

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South Africa

|

|

Key Market Players

|

- IPG Automotive GmbH

- Weiss Technik

- NTS

- SGS

- Iwasaki Electric

- Dell Technologies

- Angstrom Engineering

- Horiba

- Element

- Stange Elektronik

- Other Key Players

|

|

Report Coverage

|

- Industry Trends

- SWOT Analysis

- PESTEL Analysis

- Porter’s Five Forces Analysis

- Market Competition by Manufacturers

- Key Companies Profiled

- Marketing Channel, Distributors and Customers

- Market Dynamics

- Production and Supply Forecast

- Demand Forecast

- Research Findings and Conclusion

|

TABLE OF CONTENTS

1 Introduction to Research & Analysis Reports

1.1 Environmental Simulation Systemand Device Market Definition

1.2 Market Segments

1.2.1 Market by Type

1.2.2 Market by Application

1.3 Global Environmental Simulation Systemand Device Market Overview

1.4 Features & Benefits of This Report

1.5 Methodology & Sources of Information

1.5.1 Research Methodology

1.5.2 Research Process

1.5.3 Base Year

1.5.4 Report Assumptions & Caveats

2 Global Environmental Simulation Systemand Device Overall Market Size

2.1 Global Environmental Simulation Systemand Device Market Size: 2023 VS 2030

2.2 Global Environmental Simulation Systemand Device Market Size, Prospects & Forecasts: 2019-2030

2.3 Key Market Trends, Opportunity, Drivers and Restraints

2.3.1 Market Opportunities & Trends

2.3.2 Market Drivers

2.3.3 Market Restraints

3 Company Landscape

3.1 Top Environmental Simulation Systemand Device Players in Global Market

3.2 Top Global Environmental Simulation Systemand Device Companies Ranked by Revenue

3.3 Global Environmental Simulation Systemand Device Revenue by Companies

3.4 Top 3 and Top 5 Environmental Simulation Systemand Device Companies in Global Market, by Revenue in 2023

3.5 Global Companies Environmental Simulation Systemand Device Product Type

3.6 Tier 1, Tier 2 and Tier 3 Environmental Simulation Systemand Device Players in Global Market

3.6.1 List of Global Tier 1 Environmental Simulation Systemand Device Companies

3.6.2 List of Global Tier 2 and Tier 3 Environmental Simulation Systemand Device Companies

4 Market Sights by Product

4.1 Overview

4.1.1 By Type - Global Environmental Simulation Systemand Device Market Size Markets, 2023 & 2030

4.1.2 Software

4.1.3 Hardware

4.2 By Type - Global Environmental Simulation Systemand Device Revenue & Forecasts

4.2.1 By Type - Global Environmental Simulation Systemand Device Revenue, 2019-2024

4.2.2 By Type - Global Environmental Simulation Systemand Device Revenue, 2025-2030

4.2.3 By Type - Global Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

5 Sights by Application

5.1 Overview

5.1.1 By Application - Global Environmental Simulation Systemand Device Market Size, 2023 & 2030

5.1.2 Car

5.1.3 Electric

5.1.4 Battery

5.1.5 Other

5.2 By Application - Global Environmental Simulation Systemand Device Revenue & Forecasts

5.2.1 By Application - Global Environmental Simulation Systemand Device Revenue, 2019-2024

5.2.2 By Application - Global Environmental Simulation Systemand Device Revenue, 2025-2030

5.2.3 By Application - Global Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

6 Sights by Region

6.1 By Region - Global Environmental Simulation Systemand Device Market Size, 2023 & 2030

6.2 By Region - Global Environmental Simulation Systemand Device Revenue & Forecasts

6.2.1 By Region - Global Environmental Simulation Systemand Device Revenue, 2019-2024

6.2.2 By Region - Global Environmental Simulation Systemand Device Revenue, 2025-2030

6.2.3 By Region - Global Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

6.3 North America

6.3.1 By Country - North America Environmental Simulation Systemand Device Revenue, 2019-2030

6.3.2 US Environmental Simulation Systemand Device Market Size, 2019-2030

6.3.3 Canada Environmental Simulation Systemand Device Market Size, 2019-2030

6.3.4 Mexico Environmental Simulation Systemand Device Market Size, 2019-2030

6.4 Europe

6.4.1 By Country - Europe Environmental Simulation Systemand Device Revenue, 2019-2030

6.4.2 Germany Environmental Simulation Systemand Device Market Size, 2019-2030

6.4.3 France Environmental Simulation Systemand Device Market Size, 2019-2030

6.4.4 U.K. Environmental Simulation Systemand Device Market Size, 2019-2030

6.4.5 Italy Environmental Simulation Systemand Device Market Size, 2019-2030

6.4.6 Russia Environmental Simulation Systemand Device Market Size, 2019-2030

6.4.7 Nordic Countries Environmental Simulation Systemand Device Market Size, 2019-2030

6.4.8 Benelux Environmental Simulation Systemand Device Market Size, 2019-2030

6.5 Asia

6.5.1 By Region - Asia Environmental Simulation Systemand Device Revenue, 2019-2030

6.5.2 China Environmental Simulation Systemand Device Market Size, 2019-2030

6.5.3 Japan Environmental Simulation Systemand Device Market Size, 2019-2030

6.5.4 South Korea Environmental Simulation Systemand Device Market Size, 2019-2030

6.5.5 Southeast Asia Environmental Simulation Systemand Device Market Size, 2019-2030

6.5.6 India Environmental Simulation Systemand Device Market Size, 2019-2030

6.6 South America

6.6.1 By Country - South America Environmental Simulation Systemand Device Revenue, 2019-2030

6.6.2 Brazil Environmental Simulation Systemand Device Market Size, 2019-2030

6.6.3 Argentina Environmental Simulation Systemand Device Market Size, 2019-2030

6.7 Middle East & Africa

6.7.1 By Country - Middle East & Africa Environmental Simulation Systemand Device Revenue, 2019-2030

6.7.2 Turkey Environmental Simulation Systemand Device Market Size, 2019-2030

6.7.3 Israel Environmental Simulation Systemand Device Market Size, 2019-2030

6.7.4 Saudi Arabia Environmental Simulation Systemand Device Market Size, 2019-2030

6.7.5 UAE Environmental Simulation Systemand Device Market Size, 2019-2030

7 Environmental Simulation Systemand Device Companies Profiles

7.1 IPG Automotive GmbH

7.1.1 IPG Automotive GmbH Company Summary

7.1.2 IPG Automotive GmbH Business Overview

7.1.3 IPG Automotive GmbH Environmental Simulation Systemand Device Major Product Offerings

7.1.4 IPG Automotive GmbH Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.1.5 IPG Automotive GmbH Key News & Latest Developments

7.2 Weiss Technik

7.2.1 Weiss Technik Company Summary

7.2.2 Weiss Technik Business Overview

7.2.3 Weiss Technik Environmental Simulation Systemand Device Major Product Offerings

7.2.4 Weiss Technik Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.2.5 Weiss Technik Key News & Latest Developments

7.3 NTS

7.3.1 NTS Company Summary

7.3.2 NTS Business Overview

7.3.3 NTS Environmental Simulation Systemand Device Major Product Offerings

7.3.4 NTS Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.3.5 NTS Key News & Latest Developments

7.4 SGS

7.4.1 SGS Company Summary

7.4.2 SGS Business Overview

7.4.3 SGS Environmental Simulation Systemand Device Major Product Offerings

7.4.4 SGS Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.4.5 SGS Key News & Latest Developments

7.5 Iwasaki Electric

7.5.1 Iwasaki Electric Company Summary

7.5.2 Iwasaki Electric Business Overview

7.5.3 Iwasaki Electric Environmental Simulation Systemand Device Major Product Offerings

7.5.4 Iwasaki Electric Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.5.5 Iwasaki Electric Key News & Latest Developments

7.6 Dell Technologies

7.6.1 Dell Technologies Company Summary

7.6.2 Dell Technologies Business Overview

7.6.3 Dell Technologies Environmental Simulation Systemand Device Major Product Offerings

7.6.4 Dell Technologies Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.6.5 Dell Technologies Key News & Latest Developments

7.7 Angstrom Engineering

7.7.1 Angstrom Engineering Company Summary

7.7.2 Angstrom Engineering Business Overview

7.7.3 Angstrom Engineering Environmental Simulation Systemand Device Major Product Offerings

7.7.4 Angstrom Engineering Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.7.5 Angstrom Engineering Key News & Latest Developments

7.8 Horiba

7.8.1 Horiba Company Summary

7.8.2 Horiba Business Overview

7.8.3 Horiba Environmental Simulation Systemand Device Major Product Offerings

7.8.4 Horiba Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.8.5 Horiba Key News & Latest Developments

7.9 Element

7.9.1 Element Company Summary

7.9.2 Element Business Overview

7.9.3 Element Environmental Simulation Systemand Device Major Product Offerings

7.9.4 Element Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.9.5 Element Key News & Latest Developments

7.10 Stange Elektronik

7.10.1 Stange Elektronik Company Summary

7.10.2 Stange Elektronik Business Overview

7.10.3 Stange Elektronik Environmental Simulation Systemand Device Major Product Offerings

7.10.4 Stange Elektronik Environmental Simulation Systemand Device Revenue in Global Market (2019-2024)

7.10.5 Stange Elektronik Key News & Latest Developments

8 Conclusion

9 Appendix

9.1 Note

9.2 Examples of Clients

9.3 Disclaimer

LIST OF TABLES & FIGURES

List of Tables

Table 1. Environmental Simulation Systemand Device Market Opportunities & Trends in Global Market

Table 2. Environmental Simulation Systemand Device Market Drivers in Global Market

Table 3. Environmental Simulation Systemand Device Market Restraints in Global Market

Table 4. Key Players of Environmental Simulation Systemand Device in Global Market

Table 5. Top Environmental Simulation Systemand Device Players in Global Market, Ranking by Revenue (2023)

Table 6. Global Environmental Simulation Systemand Device Revenue by Companies, (US$, Mn), 2019-2024

Table 7. Global Environmental Simulation Systemand Device Revenue Share by Companies, 2019-2024

Table 8. Global Companies Environmental Simulation Systemand Device Product Type

Table 9. List of Global Tier 1 Environmental Simulation Systemand Device Companies, Revenue (US$, Mn) in 2023 and Market Share

Table 10. List of Global Tier 2 and Tier 3 Environmental Simulation Systemand Device Companies, Revenue (US$, Mn) in 2023 and Market Share

Table 11. By Type ? Global Environmental Simulation Systemand Device Revenue, (US$, Mn), 2023 & 2030

Table 12. By Type - Environmental Simulation Systemand Device Revenue in Global (US$, Mn), 2019-2024

Table 13. By Type - Environmental Simulation Systemand Device Revenue in Global (US$, Mn), 2025-2030

Table 14. By Application ? Global Environmental Simulation Systemand Device Revenue, (US$, Mn), 2023 & 2030

Table 15. By Application - Environmental Simulation Systemand Device Revenue in Global (US$, Mn), 2019-2024

Table 16. By Application - Environmental Simulation Systemand Device Revenue in Global (US$, Mn), 2025-2030

Table 17. By Region ? Global Environmental Simulation Systemand Device Revenue, (US$, Mn), 2023 & 2030

Table 18. By Region - Global Environmental Simulation Systemand Device Revenue (US$, Mn), 2019-2024

Table 19. By Region - Global Environmental Simulation Systemand Device Revenue (US$, Mn), 2025-2030

Table 20. By Country - North America Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2024

Table 21. By Country - North America Environmental Simulation Systemand Device Revenue, (US$, Mn), 2025-2030

Table 22. By Country - Europe Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2024

Table 23. By Country - Europe Environmental Simulation Systemand Device Revenue, (US$, Mn), 2025-2030

Table 24. By Region - Asia Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2024

Table 25. By Region - Asia Environmental Simulation Systemand Device Revenue, (US$, Mn), 2025-2030

Table 26. By Country - South America Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2024

Table 27. By Country - South America Environmental Simulation Systemand Device Revenue, (US$, Mn), 2025-2030

Table 28. By Country - Middle East & Africa Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2024

Table 29. By Country - Middle East & Africa Environmental Simulation Systemand Device Revenue, (US$, Mn), 2025-2030

Table 30. IPG Automotive GmbH Company Summary

Table 31. IPG Automotive GmbH Environmental Simulation Systemand Device Product Offerings

Table 32. IPG Automotive GmbH Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 33. IPG Automotive GmbH Key News & Latest Developments

Table 34. Weiss Technik Company Summary

Table 35. Weiss Technik Environmental Simulation Systemand Device Product Offerings

Table 36. Weiss Technik Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 37. Weiss Technik Key News & Latest Developments

Table 38. NTS Company Summary

Table 39. NTS Environmental Simulation Systemand Device Product Offerings

Table 40. NTS Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 41. NTS Key News & Latest Developments

Table 42. SGS Company Summary

Table 43. SGS Environmental Simulation Systemand Device Product Offerings

Table 44. SGS Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 45. SGS Key News & Latest Developments

Table 46. Iwasaki Electric Company Summary

Table 47. Iwasaki Electric Environmental Simulation Systemand Device Product Offerings

Table 48. Iwasaki Electric Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 49. Iwasaki Electric Key News & Latest Developments

Table 50. Dell Technologies Company Summary

Table 51. Dell Technologies Environmental Simulation Systemand Device Product Offerings

Table 52. Dell Technologies Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 53. Dell Technologies Key News & Latest Developments

Table 54. Angstrom Engineering Company Summary

Table 55. Angstrom Engineering Environmental Simulation Systemand Device Product Offerings

Table 56. Angstrom Engineering Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 57. Angstrom Engineering Key News & Latest Developments

Table 58. Horiba Company Summary

Table 59. Horiba Environmental Simulation Systemand Device Product Offerings

Table 60. Horiba Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 61. Horiba Key News & Latest Developments

Table 62. Element Company Summary

Table 63. Element Environmental Simulation Systemand Device Product Offerings

Table 64. Element Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 65. Element Key News & Latest Developments

Table 66. Stange Elektronik Company Summary

Table 67. Stange Elektronik Environmental Simulation Systemand Device Product Offerings

Table 68. Stange Elektronik Environmental Simulation Systemand Device Revenue (US$, Mn) & (2019-2024)

Table 69. Stange Elektronik Key News & Latest Developments

List of Figures

Figure 1. Environmental Simulation Systemand Device Segment by Type in 2023

Figure 2. Environmental Simulation Systemand Device Segment by Application in 2023

Figure 3. Global Environmental Simulation Systemand Device Market Overview: 2023

Figure 4. Key Caveats

Figure 5. Global Environmental Simulation Systemand Device Market Size: 2023 VS 2030 (US$, Mn)

Figure 6. Global Environmental Simulation Systemand Device Revenue, 2019-2030 (US$, Mn)

Figure 7. The Top 3 and 5 Players Market Share by Environmental Simulation Systemand Device Revenue in 2023

Figure 8. By Type - Global Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 9. By Application - Global Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 10. By Type - Global Environmental Simulation Systemand Device Revenue, (US$, Mn), 2023 & 2030

Figure 11. By Type - Global Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 12. By Application - Global Environmental Simulation Systemand Device Revenue, (US$, Mn), 2023 & 2030

Figure 13. By Application - Global Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 14. By Region - Global Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 15. By Country - North America Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 16. US Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 17. Canada Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 18. Mexico Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 19. By Country - Europe Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 20. Germany Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 21. France Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 22. U.K. Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 23. Italy Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 24. Russia Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 25. Nordic Countries Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 26. Benelux Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 27. By Region - Asia Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 28. China Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 29. Japan Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 30. South Korea Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 31. Southeast Asia Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 32. India Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 33. By Country - South America Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 34. Brazil Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 35. Argentina Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 36. By Country - Middle East & Africa Environmental Simulation Systemand Device Revenue Market Share, 2019-2030

Figure 37. Turkey Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 38. Israel Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 39. Saudi Arabia Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 40. UAE Environmental Simulation Systemand Device Revenue, (US$, Mn), 2019-2030

Figure 41. IPG Automotive GmbH Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 42. Weiss Technik Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 43. NTS Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 44. SGS Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 45. Iwasaki Electric Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 46. Dell Technologies Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 47. Angstrom Engineering Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 48. Horiba Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 49. Element Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)

Figure 50. Stange Elektronik Environmental Simulation Systemand Device Revenue Year Over Year Growth (US$, Mn) & (2019-2024)