TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

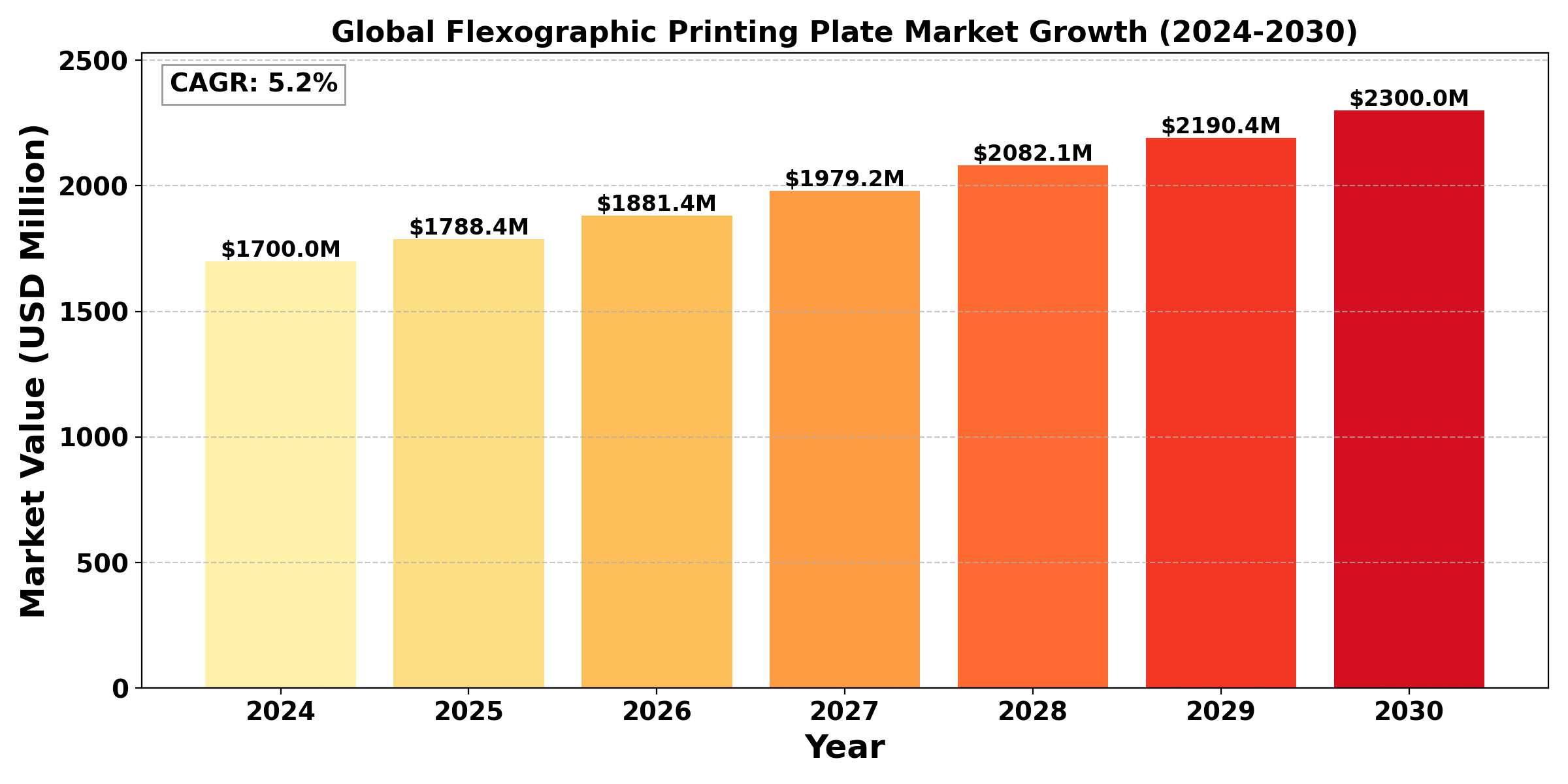

The "Global Flexographic Printing Plate Market" was valued at US$ 1.7 Billion in 2024 and is projected to reach US$ 2.3 Billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period (2024-2030).

The need for high-quality, effective, and adaptable printing solutions across a range of industries, especially packaging, is driving the flexographic printing plate market, a crucial area of the worldwide printing industry. Because they enable quick and large-scale printing on a variety of substrates, including paper, plastic, metal, and foil, flexographic printing plates are used extensively in the manufacturing of packaging materials, such as corrugated boxes, flexible packaging, labels, and folding cartons. This technique is highly regarded for its versatility, ability to print at high speeds, and ability to produce clear, accurate images, which makes it perfect for package applications requiring intricate graphics and colors unique to a brand.

The market for flexographic printing plates has been greatly boosted by the increase in e-commerce and the resulting need for aesthetically pleasing, branded packaging. Furthermore, improvements in plate materials and inks brought about by the trend toward sustainable packaging solutions have made it possible to print environmentally friendly designs that satisfy both legal and consumer requirements. The quality and effectiveness of flexographic printing are being further improved by technological advancements such as digital imaging and photopolymer plates, which provide quicker plate manufacture, better image consistency, and less waste. The market for flexographic printing plates is expected to grow further due to advancements and growing applications across end-use sectors as businesses look for high-quality, sustainable printing solutions.

Segmental Analysis

Digital Flexographic Plates to hold the highest market share: By Type

In terms of type, the global market has been segmented Digital Flexographic Plates, Analog Flexographic Plates.

Due to their higher image quality, consistency, and production efficiency over analog plates, digital flexographic plates currently have the largest market share in the global flexographic printing plate industry. By using cutting-edge imaging technology, digital plates do not require film processing, which speeds up plate production and lowers labor and material costs. Because of this, digital plates are very appealing for label printing and packaging applications where accuracy and quality are crucial. The industry's drive for automation and more efficient processes is also in line with the use of digital flexographic plates, which provide quicker switchovers and increased productivity—two factors that are especially advantageous in settings with high production volumes.

Additionally, digital flexographic plates offer improved color accuracy and image quality, satisfying the ever-higher criteria for packaging aesthetics set by businesses. This requirement has increased due to the growth of e-commerce and the desire for branded packaging, as businesses look for striking designs to set their products apart. Although certain less demanding or cost-sensitive applications still use analog flexographic plates, they usually lack the efficiency and image quality benefits of digital plates. Therefore, as the industry adopts digital advances, it is anticipated that the trend toward digital flexographic plates will continue, further solidifying their market share advantage.

Solvent-washable Flexographic Plates to hold the highest market share

Solvent-washable flexographic plates are the market leader in the global flexographic printing plate industry. Because of their longevity, excellent output, and suitability for a wide range of inks and substrates, these plates have long been the industry standard. After imaging, the plate surface is cleaned and developed using a solvent-based technique in solvent-washable plates, producing fine details and excellent picture quality. In packaging, where companies demand crisp graphics and vivid colors, their capacity to manage small details and high-definition printing makes them very useful.

Solvent-washable plates continue to hold a higher market share despite increased interest in other plate types such as digital and water-washable flexographic plates. This is mostly because of their well-established infrastructure and broad compatibility with a variety of presses and materials. Furthermore, solvent-washable plates are economical for high-volume applications, especially in the packaging industry, because they provide the durability required for extended runs.

Regional Overview

North America, Europe, and Asia-Pacific are the three main regions driving the global market for flexographic printing plates, and each has its own characteristics affecting demand. The increasing need for flexographic printing in labels, packaging, and branded materials—especially with the growth of e-commerce—gives North America a dominant position. Europe comes in second thanks to strict packaging regulations, an emphasis on eco-friendly materials, and the broad use of digital flexographic printing processes. The demand for superior printed packaging is also fueled by the region's thriving consumer goods industry.

Flexographic plates are becoming more and more popular in Asia-Pacific as a result of the fast expansion of consumer markets, particularly in nations like China and India, which increases demand for flexible packaging. The demand for colorful and appealing packaging is accelerated by growing industrialization and middle-class customer demand, which expands the market. With other regions sustaining robust, steady demand, Asia-Pacific is anticipated to be a significant growth driver as these trends develop.

Competitive Analysis

The competitive landscape of the global flexographic printing plate market is shaped by several prominent players and regional specialists striving to meet the growing demand for high-quality and sustainable printing solutions. Key market leaders include companies like Flint Group, DuPont, Eastman Kodak Company, Fujifilm, and Asahi Photoproducts, each leveraging extensive R&D resources to innovate and improve product offerings. These companies focus on developing advanced digital and environmentally-friendly plates, aligning with the market's push toward automation, high-definition printing, and sustainability.

Recent Development

September 2023, MacDermid Graphics Solutions announced a patent-pending technique for recycling flexographic printing plates and announced its ground-breaking collaboration with Sustainable Solutionz, LLC. By the end of the year, testing are expected to start in North America.

January 2024, Cbak Evolve, a bio-based polyethylene mounting material for corrugated post-printing, was introduced by LeadEdge Flexo. It sought to preserve high performance while lowering dependency on synthetic materials. Consistent ink coverage, decreased dot growth, and longer plate life were all claimed by the foam.

End Use Industry Analysis

Significant demand is seen in a number of industries, with packaging emerging as the most prominent one, according to the end-use industry research of the worldwide flexographic printing plate market. The growth of e-commerce and the demand for aesthetically pleasing packaging that strengthens brand identity have led to the use of flexible packaging, labels, and corrugated boxes. One significant contributor is the food and beverage sector, which demands superior prints that both draw in customers and adhere to safety standards.

Flexographic printing is often used in the healthcare industry to package medications and medical supplies, where accuracy and adherence to strict guidelines are crucial. Flexographic plates are especially advantageous to the cosmetics and personal care sector, which uses them to create eye-catching packaging that embodies brand identity. With advancements improving their usefulness and efficiency in satisfying the various demands of end users, the market for flexographic printing plates is anticipated to increase as long as industries continue to place a high priority on sustainable, high-quality packaging solutions.

Industry Dynamics

Industry Driver

Growing demand for Sustainable Packaging Solutions

The increasing need for environmentally friendly packaging options across a range of industries is one of the main factors propelling the flexographic printing plate market. Businesses are implementing eco-friendly methods more frequently as consumers' concerns about the environment grow in order to comply with legal obligations and these ideals. This trend is especially noticeable in the packaging industry, where companies are looking for environmentally friendly printing techniques and sustainable materials. Flexographic printing presents itself as the perfect option for companies looking to strengthen their environmental initiatives because of its capacity to employ recyclable substrates and water-based inks. Flexographic printing plates are also becoming more and more popular as a result of the move toward efficient and lightweight packaging to lower shipping costs. The focus on sustainability not only increases demand for premium flexographic printing but also fosters innovation in plate materials and methods, which in turn propels market expansion as brands look to stand out in a crowded market.

Industry Trend

Increased adoption of digital flexographic printing technology

A significant trend in the flexographic printing plate market is the increased adoption of digital flexographic printing technology. This shift is driven by the need for faster production cycles, reduced setup times, and the capability to produce high-quality prints with intricate designs and vibrant colors. Digital flexographic plates offer the advantage of eliminating traditional film processing, streamlining workflows, and enabling on-demand printing, which is particularly beneficial for short runs and customized orders.

Moreover, as brands focus on reducing waste and improving efficiency, the flexibility of digital printing allows for quick adjustments in designs without the need for extensive plate changes. Additionally, advancements in plate materials and imaging technologies are enhancing the quality and durability of digital plates, making them a preferred choice for packaging applications. The trend towards automation and integration of Industry 4.0 technologies in printing processes further supports this movement, as manufacturers seek to optimize production and reduce costs, thereby solidifying digital flexographic printing as a leading trend in the industry.

Industry Restraint

The high initial investment cost of sophisticated technology is a major barrier to the market for flexographic printing plates. Although digital flexographic printing has several benefits, such as quicker turnaround times and better print quality, smaller printing companies may find the initial costs of equipment, software, and specialist training to be unaffordable. Because of these expenses, many traditional printers would be hesitant to switch from analog to digital processes, which could hinder the uptake of cutting-edge technologies.

The cost is further increased by the requirement for ongoing maintenance and updates for digital printing systems. Because they do not have the funds to invest in cutting-edge technology, smaller businesses may find it more difficult to compete successfully in a market that is calling for printing solutions that are both high-quality and efficient. Additionally, changes in the cost of plates and inks as raw materials can have an effect on profitability, making it difficult for businesses to keep prices competitive while making the required investments in upgrades.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application, plate Material, Plate Type, Plate Thickness. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

By plate Material

By plate Type

By Plate Thickness

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

Frequently Asked Questions ?