TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Industry Overview

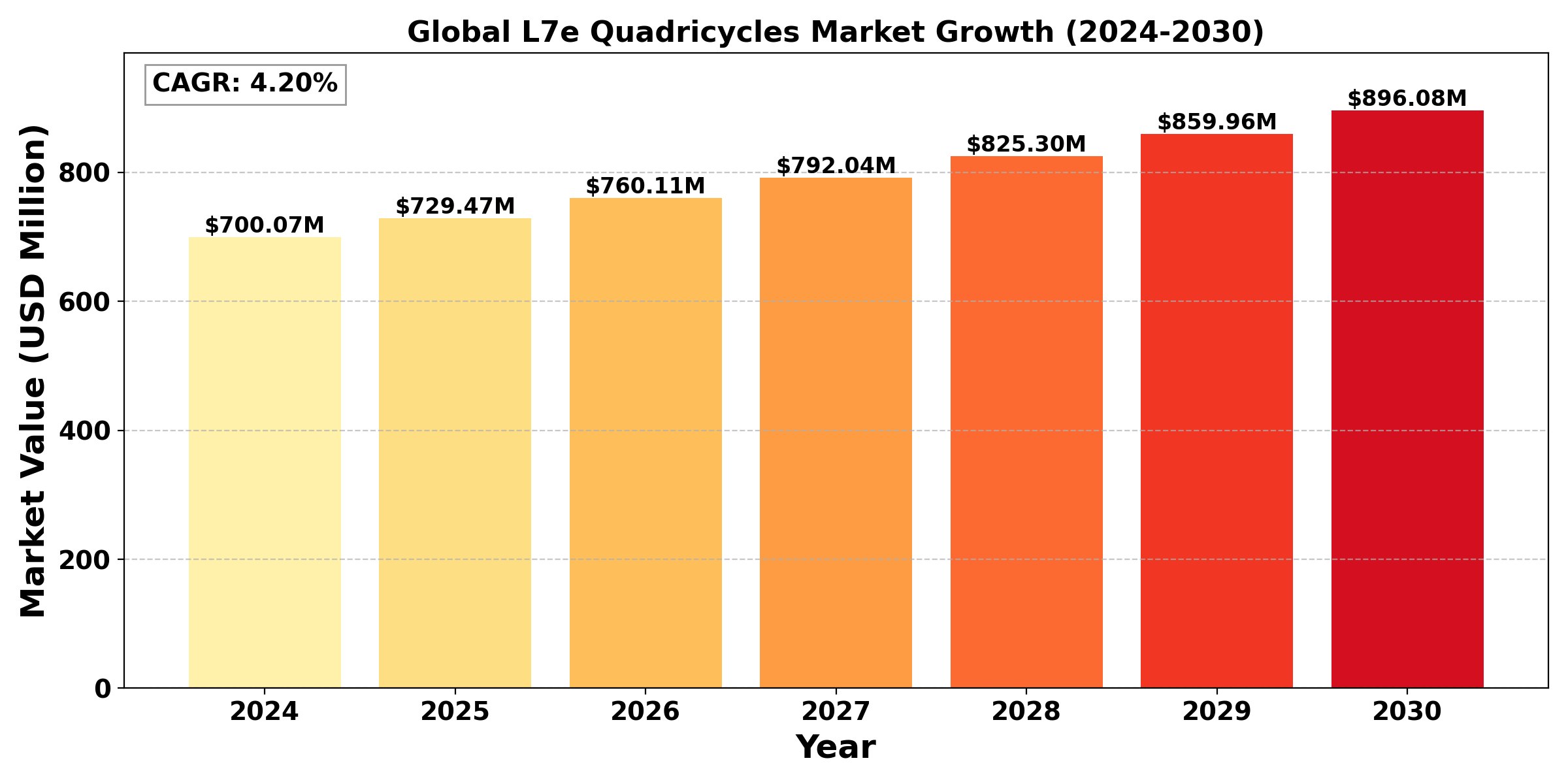

The "Global L7e Quadricycles Market" was valued at US$ 700.07 Million in 2024 and is projected to reach US$ 896.08 Million by 2030, at a CAGR of 4.20% during the forecast period.

The global L7e quadricycles market is witnessing significant growth, driven by increasing urbanization, rising demand for efficient and eco-friendly transportation solutions, and advancements in automotive technology. L7e quadricycles, also known as light quadricycles, are lightweight vehicles that offer a balance between functionality and compactness, making them ideal for urban commuting and short-distance travel. These vehicles typically have lower emissions and better fuel efficiency compared to traditional cars, aligning with global sustainability goals and stricter environmental regulations. Key players in the market are focusing on electric variants to cater to the growing demand for clean mobility solutions. Additionally, the rise of shared mobility services and the need for affordable transportation alternatives are further propelling the adoption of L7e quadricycles in various regions, particularly in Europe and Asia. As consumer preferences shift toward smaller, more efficient vehicles, the L7e quadricycles market is poised for continued expansion, attracting interest from both manufacturers and consumers seeking practical urban mobility options.

Strict laws designed to lower vehicle emissions and encourage environmentally friendly transportation have an impact on the market. By offering incentives including tax breaks, subsidies, and specialized charging infrastructure, numerous governments are promoting the usage of electric L7e quadricycles. Manufacturers are investing in electric versions as a result of this governmental assistance, which is in line with the global trend of the automobile industry toward electrification.

Segmental Analysis

L7Ae to hold the highest market share : By Variant

In terms of Variant, the Global L7e Quadricycles market has been segmented as L7Ae, L7Be, L7Ce

The L7Ae model is recognized for having the largest market share in the L7e quadricycle market, mainly because of its attractive characteristics that suit the demands of urban commuting. Because of its lightweight, small size, and agility, the L7Ae is perfect for negotiating congested city streets and confined parking areas. This version frequently has low emissions and efficient fuel usage, two features that are becoming more and more significant to consumers who care about the environment and to authorities working to reduce pollution in cities.

Vehicles that are not only affordable but also able to handle the difficulties of city living, like traffic jams and parking restrictions, are in high demand due to the growing trend of urbanization, especially in Europe and some areas of Asia. The L7Ae model has consequently gained a lot of popularity among commuters, students, and anyone seeking a backup car for quick excursions. Furthermore, government subsidies for the use of low-emission vehicles increase the L7Ae's attractiveness and strengthen its position in the market.

A significant share of the market is also controlled by the L7Be version. This version typically serves customers seeking extra features or somewhat better performance, such stronger engines or more room for passengers. The L7Be is a popular choice for families and small companies due to its adaptability, which draws purchasers who need a vehicle that can handle both daily commuting and occasional longer journeys as urban populations rise.

Electric L7e Quadricycles, , to hold the highest market share: By type

In terms of type, the market has been segmented as Electric L7e Quadricycles, Combustion Engine L7e Quadricycles

Due to a global trend toward environmentally friendly and sustainable modes of transportation, electric L7e quadricycles are gaining market share in the L7e quadricycles industry. Electric quadricycles present an alluring substitute for conventional combustion engine cars as metropolitan areas struggle with problems including air pollution, traffic jams, and climate change. Due to their zero tailpipe emissions, lower operating costs, and decreased noise pollution, these electric versions are especially appealing to city dwellers and people who care about the environment. The demand for electric L7e quadricycles is also being increased by the fact that many governments are enacting policies that support EVs, including as tax breaks, subsidies, and the development of charging infrastructure.

However, Combustion Engine L7e quadricycles continue to be a major player in the market, especially in areas with poor charging infrastructure or where customers are more used to traditional automobiles. Because they may be more widely available and have lower initial costs than their electric counterparts, these models frequently appeal to consumers seeking affordability and proven technology. However, it is anticipated that the market share of quadricycles powered by combustion engines would steadily decrease as technology develops and the trend toward electrification continues.

Regional Overview

The market for L7e quadricycles exhibits notable regional variances that are influenced by regional customer preferences, legal frameworks, and financial circumstances. The market is especially strong in Europe with to strict emissions laws and a strong drive for environmentally friendly transportation options. The use of electric L7e quadricycles has increased in nations like France, Italy, and the Netherlands because to government incentives and rising environmental consciousness. A wide variety of manufacturers offering different models to suit both enterprises and urban commuters define the European market.

The market is expanding significantly in Asia-Pacific, especially in nations like China and India where urbanization is rising. As more people move into cities, there is a growing need for efficient, lightweight cars. Both electric and combustion engine L7e quadricycles are becoming more and more popular in these areas, however electric versions are growing in popularity as a result of better infrastructure and government encouragement of EV adoption.

North America is witnessing a gradual growth in the L7e quadricycle market, driven primarily by interest in compact and fuel-efficient vehicles. However, the market is still dominated by traditional vehicles, with consumer awareness and regulatory support for quadricycles still evolving. The focus on electric variants is increasing, but significant market penetration remains a challenge due to established automotive preferences.

In contrast, the Middle East and Africa present a more nascent market for L7e quadricycles, with limited penetration. However, urbanization and rising awareness of sustainable transport options are beginning to create opportunities for growth, particularly in urban canters.

Competitive Analysis

Established automakers and up-and-coming startups compete for market share in the quickly changing lightweight vehicle class, which is the hallmark of the competitive landscape of the L7e quadricycles market. Important participants, such as large automakers, use their wealth of production, distribution, and technological know-how to create cutting-edge quadricycle models that satisfy urban consumers' needs. To stay competitive in a market that is becoming more and more focused on efficiency and sustainability, these businesses frequently make significant investments in R&D to improve vehicle performance, safety features, and connectivity possibilities.

Recent Development

➣ April 30th, 2030, Nissan has entered into an agreement with a Spanish start up named Silence to distribute an electric quadricycle in Europe. Starting June 2024, Nissan will sell Silence's compact 504 Nanocar in Italy and France, with plans for further expansion into additional European markets by September.

➣ 9th January, 2024, WiTricity and ICON EV unveiled the 2024 ICON Low-Speed Vehicles (LSVs), introducing an industry-first wireless charging option.

End Use Analysis

Demand for these lightweight vehicles is driven by a variety of consumer categories and applications, as demonstrated by the end-use analysis of the L7e quadricycle market. L7e quadricycles are mostly used for urban commuting, which appeals to people looking for a cost-effective and efficient way to get around in crowded metropolitan settings. These cars offer a more environmentally friendly option to conventional cars while solving the problems of parking and traffic congestion, making them the perfect choice for short-distance travel.

L7e quadricycles are becoming more and more popular among service providers and small enterprises in addition to individual commuters. These vehicles are used by small companies, food vendors, and delivery services because of their low operating costs and mobility, which make them ideal for navigating urban environments. Businesses can move items more effectively thanks to the L7e quadricycle's compact form, which also improves service quality and delivery times.

Furthermore, a number of industries are adopting electric L7e quadricycles as a result of the growing trend of sustainable mobility. By incorporating these cars into their fleets, companies that prioritize corporate sustainability are lowering their carbon footprint and supporting environmentally beneficial activities. This tendency is especially noticeable in industries like tourism and rental services, where businesses aim to provide clients with eco-friendly choices.

Between 2010 and 2017, there has been a trend growth in the motorcycles and quadricycle market share at the expense of mopeds in European L-Category markets. Registrations of L-Category vehicles in the EU in 2017 were reported to be 1.3 million vehicles, with quadricycles making up 3.6% of all L-Category registrations; a marked drop from what had been a trend growth in the market share of quadricycles. In 2017 there were 34,392 electric-powered L-Category vehicles registered in the EU, which represents 2.5% of total L-Category registrations, up from 0.7% in 2011,

Electric L7e vehicles accounted for ‘over 18.58% of UK market sales of L7e category vehicles in 2021’ (Department for Transport, 2022). It is expected that there will be a launch of ‘a wide range of new electric quadricycles into the UK market, highlighting this technology is already available, affordable and practical’

Industry Dynamics

Increasing emphasis on sustainable urban mobility solutions

The growing focus on sustainable urban mobility solutions is one of the main factors propelling the L7e quadricycle market. The need for environmentally sustainable transportation options has increased as cities throughout the world struggle with issues including air pollution, traffic congestion, and climate change. L7e quadricycles, especially electric models, are becoming a good choice for city commuting because of their fuel efficiency, low emissions, and lightweight construction. These automobiles are designed especially for short-distance travel in crowded places, where conventional cars can be inconvenient and worsen traffic.

By enacting stronger emissions laws and providing incentives for the purchase of low-emission vehicles, such as electric L7e quadricycles, governments are also instrumental in advancing sustainable mobility. Tax breaks, subsidies, and investments in charging infrastructure are a few examples of these incentives, which increase the allure of switching from traditional cars to these eco-friendly alternatives for consumers. The demand for L7e quadricycles is also being driven by growing consumer awareness of environmental issues and the advantages of sustainable living. As urban populations continue to expand and cities seek innovative solutions to reduce their carbon footprints, the drive towards sustainable urban mobility is expected to significantly boost the L7e quadricycles market in the coming years.

Limited awareness and acceptance of these vehicles among consumers

The low level of public awareness and adoption of L7e quadricycles is one of the major obstacles facing the business. Many prospective purchasers might not completely comprehend the advantages or suitability of L7e quadricycles for their transportation needs, despite its advantages in terms of efficiency, mobility, and environmental impact. This ignorance can be especially noticeable in areas where conventional cars predominate, which makes people reluctant to use these alternate forms of transportation.

Furthermore, the belief that quadricycles are less reliable or strong than regular cars may make it more difficult for them to be accepted. The performance, safety features, and general usability of L7e quadricycles may worry some buyers, especially for lengthy rides or in inclement weather. Regulation variations across different jurisdictions may make this view worse by limiting the number of possible users for quadricycles by not classifying them as appropriate for all driving circumstances.

Furthermore, despite long-term fuel and maintenance savings, the initial expense of buying electric L7e quadricycles may put off buyers who are hesitant to make a sizable upfront commitment. All of these elements work together to create a difficult market climate that limits the L7e quadricycles industry's ability to grow as it looks to increase its customer base and take on more established vehicle categories.

Industry Trend

The L7e quadricycles industry is experiencing several notable trends that reflect the evolving landscape of urban mobility and consumer preferences. One prominent trend is the shift towards electrification. As concerns about climate change and air quality intensify, there is a growing demand for electric L7e quadricycles, which offer a sustainable alternative to traditional combustion engine vehicles. Manufacturers are increasingly investing in electric models that feature advanced battery technologies, enhancing their range and performance to meet consumer expectations. This trend is supported by government incentives and policies aimed at promoting electric vehicles, further driving adoption.

Another significant trend is the integration of smart technologies into L7e quadricycles. As consumers become more tech-savvy, there is a rising demand for vehicles equipped with features such as advanced connectivity, navigation systems, and infotainment options. This integration not only enhances the user experience but also increases safety and efficiency, making L7e quadricycles more appealing to a broader audience, particularly younger urban dwellers.

Additionally, the market is witnessing a focus on customization and design. Manufacturers are offering a variety of models with customizable features to cater to diverse consumer preferences, including aesthetic options and functional enhancements. This trend toward personalization allows consumers to choose vehicles that align with their lifestyle and values, fostering a sense of ownership and satisfaction.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Variant, type, Application, End Use Industry, Distribution Channel. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Variant: L7Ae L7Be L7Ce By Type: Electric L7e Quadricycles Combustion Engine L7e Quadricycles By Application: Household Commercial By End-User: Personal Use Commercial Use (e.g., Delivery, Tourism) By Distribution Channel: OEMs Dealerships Online Retailers |

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

Frequently Asked Questions ?