TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Industry overview

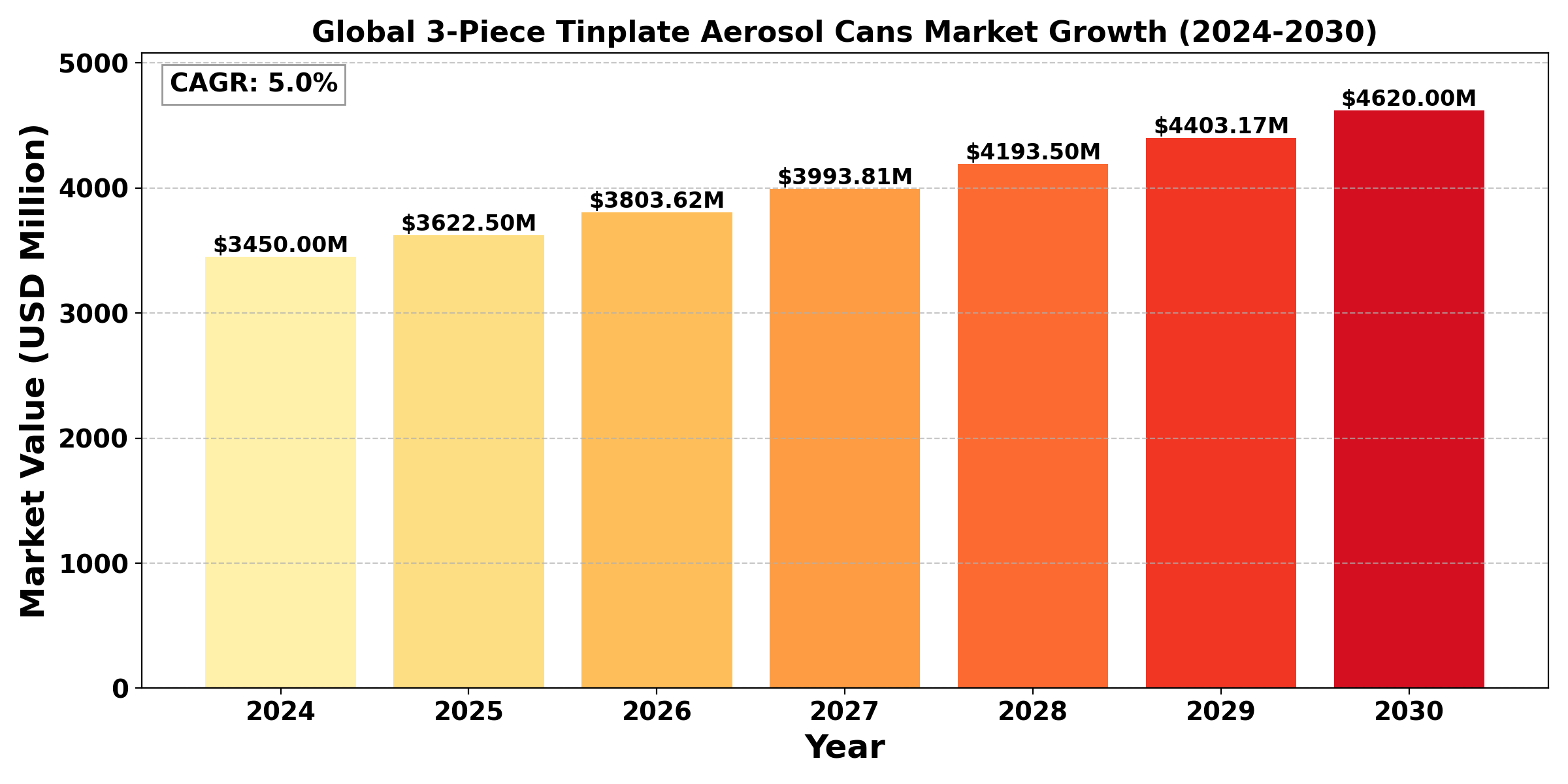

The "Global 3-Piece Tinplate Aerosol Cans Market" was valued at US$ 3.45 billion in 2024 and is projected to reach US$ 4.62 billion by 2030, at a CAGR of 5.0% during the forecast period 2024-2030.

Growing demand from a variety of industries, such as personal care, home goods, and industrial applications, is propelling the global market for 3-piece tinplate aerosol cans. These cans are favoured for packaging aerosols like deodorants, hair sprays, and cleaning products because of their longevity, recyclable nature, and capacity to efficiently retain the contents. Tinplate is a recyclable material that supports sustainability activities, therefore the market has been supported by the rise in eco-friendly packaging trends. Furthermore, improvements in production techniques and can design are improving the performance and safety of the product.

Geographically, Asia-Pacific dominates because of its growing consumer markets and manufacturing base, but North America and Europe still have strong demand, especially in the personal care and pharmaceutical industries. Although market dynamics may be impacted by obstacles like shifting raw material prices and competition from substitute packaging options, the general picture is still optimistic as more and more businesses choose tinplate aerosol cans for their packaging requirements.

Industry Segment

Standard Aerosol Cans to hold the highest market share: By Type

Standard aerosol cans have the largest market share in the global market for 3-piece tinplate aerosol cans because of their extensive use and adaptability to a wide range of applications. These cans, which benefit from well-established production procedures and customer familiarity, are mostly used for food applications, household cleaning products, and personal care items. For manufacturers looking to fulfil rising demand while keeping prices competitive, the standard design enables cost-effectiveness and efficient production.

On the other hand, shaped aerosol cans make up a lesser portion of the market, although becoming more popular due to their visual appeal and ability to differentiate brands. They are frequently used for high-end goods or specialized markets where aesthetic impact is essential. Although consumers are drawn to the creative shapes of shaped cans, their market share is restricted in comparison to normal cans due to the higher production costs and longer lead times involved in their manufacturing. As a result, the market is still dominated by the desire for conventional aerosol cans.

Personal care segment to hold the highest market share: By Application

The personal care category has the largest market share in the global market for 3-piece tinplate aerosol cans due to steady demand for goods like shaving creams, hair sprays, and deodorants. The use of aerosol cans in the personal care business has grown dramatically as a result of the industry's expansion, which has been driven by shifting customer preferences for grooming and hygiene goods. Customers greatly appreciate the convenience, use, and efficient dispensing that these cans offer.

A significant portion of the market is also accounted for by the domestic category, which includes air fresheners and cleaning supplies. But in terms of market share, it trails personal care. The insecticide market benefits from continuous agricultural needs and pest control initiatives, while the industrial and insecticide segments are smaller but equally important. Despite their significance, the personal care industry is the most common use for tinplate aerosol cans because to its strong growth and innovation, which reflects customer preferences for self-care and personal grooming.

Regional Analysis

The regional analysis of the global 3-piece tinplate aerosol cans market reveals distinct trends and growth drivers across various geographies. Driven by fast industrialization, a growing middle class, and rising disposable incomes, especially in nations like China and India, Asia-Pacific becomes the largest market. The region's market supremacy is largely due to its robust manufacturing base and growing demand for household and personal care products. Following is North America, where the market is aided by cutting-edge packaging innovations, a strong focus on sustainability, and a significant customer desire for aerosol products for use in domestic and personal care applications. Strong increase is also seen in Europe, where strict laws encouraging eco-friendly packaging and creative designs are the main drivers.

Although they now have lesser market shares, Latin America and the Middle East and Africa are steadily gaining ground thanks to urbanization and changing consumer habits. All things considered, consumer preferences, economic variables, and regulatory forces influencing global growth trajectories are reflected in the market's regional dynamics.

Competitive Landscape

Recent Development

➣ May 7th, 2024, Mauser Packaging Solutions announced the completion of acquisition of its wholly-owned subsidiary, BWAY Corporation. “We are happy to welcome Taenza to our Mauser family,” said Mark Burgess, Chief Executive Officer, Mauser Packaging Solutions. “Taenza’s legacy manufacturing capability and strong local presence in the Mexican markets combined with Mauser’s global network will enable us to make the Taenza business, and Mauser, more successful in the future.” It is anticipated that the deal will enhance Mauser's current operations and offer Mauser a number of significant strategic advantages, such as expansion prospects in the Mexican paint, sanitary, and specialty industries as well as more production sites, capacity, and capabilities.

➣ February 28th, 2024, Enova, a regional leader in integrated energy and multi-technical services, and Sarten Ambalaj, a well-known packaging producer in Turkey, have partnered to promote environmental sustainability. They recently signed a deal to install rooftop solar systems in a number of Sarsen's operational sites.

End Use Industry Analysis

Personal care, home goods, food and drink, pharmaceuticals, and industrial applications are some of the end-use industries that have an impact on the global market for 3-piece tinplate aerosol cans. A increasing need for portable and easy-to-use packaging solutions has made personal care products—like deodorants, hair sprays, and cosmetics—one of the biggest consumers. Because cleanliness and hygiene are becoming more and more important, aerosol cans are used extensively in the home industry for cleansers, air fresheners, and pest control solutions. For items like whipped cream and cooking oils, the food and beverage industry uses aerosol cans because of their ability to maintain freshness and guarantee user-friendliness, which appeals to consumer tastes.

Another important role is played by the pharmaceutical industry, which uses aerosol cans to deliver metered quantities of drugs, improving patient convenience and compliance. Aerosol cans are used for lubricants and paints in a variety of industrial applications, such as the automotive and manufacturing sectors. Global demand for 3-piece tinplate aerosol cans is primarily driven by the expansion of these end-use sectors as well as growing customer preferences for eco-friendly and convenient packaging.

Industry Dynamics

Industry drivers

Growing Demand for Convenience

A notable change in consumer behavior is shown in the rising desire for packing convenience, especially as fast-paced lifestyles become more prevalent. The growing popularity of aerosol cans, which offer a number of benefits that meet the demands of contemporary customers, is a clear example of this trend. Because aerosol cans are simple to use, users can apply items quickly and effectively without creating a mess or requiring extra gear. For personal care products where convenience is crucial, such deodorants, hair sprays, and skincare products, this functionality is particularly alluring.

Aerosol packaging also improves portability, which makes it a great option for people who lead busy lives. Products that are convenient to pack in backpacks or travel kits appeal to consumers because they enable them to continue their routines wherever they go. In addition to personal care, aerosol cans make it easier to quickly obtain and apply home and food supplies, such as cooking oils and cleaning sprays.

Industry trend

Sustainability and Eco-Friendly Packaging

Sustainability is emerging as a key subject in the global market for 3-piece tinplate aerosol cans, which is undergoing numerous noteworthy changes that are influencing its future. There is a noticeable trend toward sustainable packaging options as customers grow more ecologically concerned. Manufacturers are being compelled by this trend to give priority to the development of recyclable and biodegradable aerosol cans, which will satisfy consumer demand for environmentally friendly products and comply with regulatory demands for less environmental effect.Businesses are reducing their environmental impact by inventing new materials and production techniques in response to this increased awareness. This involves investigating substitute materials that have comparable performance attributes to conventional tinplate but are more environmentally friendly. Manufacturers, for instance, are looking at using biodegradable materials, such as plant-based polymers, as alternatives to traditional packaging.

Furthermore, manufacturers are increasingly taking into account the full lifetime of aerosol cans, from production and transportation to end-of-life disposal, by implementing eco-design principles. This all-encompassing strategy involves promoting cooperation throughout the supply chain, establishing alliances with recycling groups, and educating customers about appropriate disposal techniques. Brands can successfully cut waste and support a circular economy by increasing the recyclability of their products and raising recycling rates.

Industry Restraint

Volatility in price of raw materials

The unpredictability of raw material prices, especially with regard to tinplate and other crucial components, is posing an increasing challenge to the aerosol can sector. Price fluctuations for these commodities can have a big effect on production costs, which can affect the entire manufacturing process.

Manufacturers frequently face higher operating costs as a result of rising raw material prices, which may put their profit margins at risk. Businesses may be forced to pass these expenses on to customers in the form of higher product pricing in an attempt to preserve profitability. Demand may decline as a result of this price increase since buyers may look for less expensive options or change their minds about what they buy, particularly in price-sensitive regions.

The volatility of raw material prices is caused by a wide range of intricate elements. Price volatility for tinplate can result from variations in mining output, shifts in the dynamics of global supply and demand, and geopolitical tensions. Similarly, market conditions, energy costs, and regulatory changes can impact the cost of other materials, like bioplastics and propellants used in aerosol cans.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

Frequently Asked Questions ?